An unexpected setback emerged for communications giant Comcast (CMCSA), as it worked to bolster its marketing in several different ways. Despite these moves, which should help yield improvements in revenue for its Universal unit and for its beleaguered linear television operations, shareholders proved skeptical, and sent shares down fractionally in Wednesday afternoon’s trading.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The first move came with a new partnership with Burger King (QSR), in advance of Universal’s upcoming How to Train Your Dragon live-action movie release. Burger King will release a range of special menu items, including—brace yourself for this—the Viking’s Chocolate Sundae, which appears to be a normal chocolate sundae, the kind of thing that vikings were not exactly widely known for, and the Dragon-Flame Grilled Whopper, which, again, appears to be a normal Whopper cooked in the normal fashion.

But this is part of a “family-first marketing strategy” for Burger King, and will likely help drive interest in Comcast’s upcoming movie release as well, a win for both sides. This might be particularly helpful for Burger King, who has been lagging behind its competitors in the fast food market, McDonald’s (MCD) and Wendy’s (WEN) for some time now.

A Push for the Local Market

Comcast is also ramping up its attempts to get advertisers to buy in on its linear television operations, and is doing so by enlisting artificial intelligence (AI) to help out. A new partnership with Waymark is opening up access for small and medium-sized businesses (SMBs) to get access to “premium TV audiences.” It will allow advertisers to build their own ads quickly, and effectively—though given the state of video generation in AI today, the effects might be debatable—to get access to that broader market that much faster.

Chief revenue officer for media solutions at Comcast, Dawn Williamson, noted, “Thanks to our Waymark partnership, we are excited to extend this mission directly to our Media Solutions offering. Advertisers now have a fast and affordable way to build TV-ready ads for delivery across news, entertainment, live sports, and other premium video destinations.”

Is Comcast Stock a Good Buy Right Now?

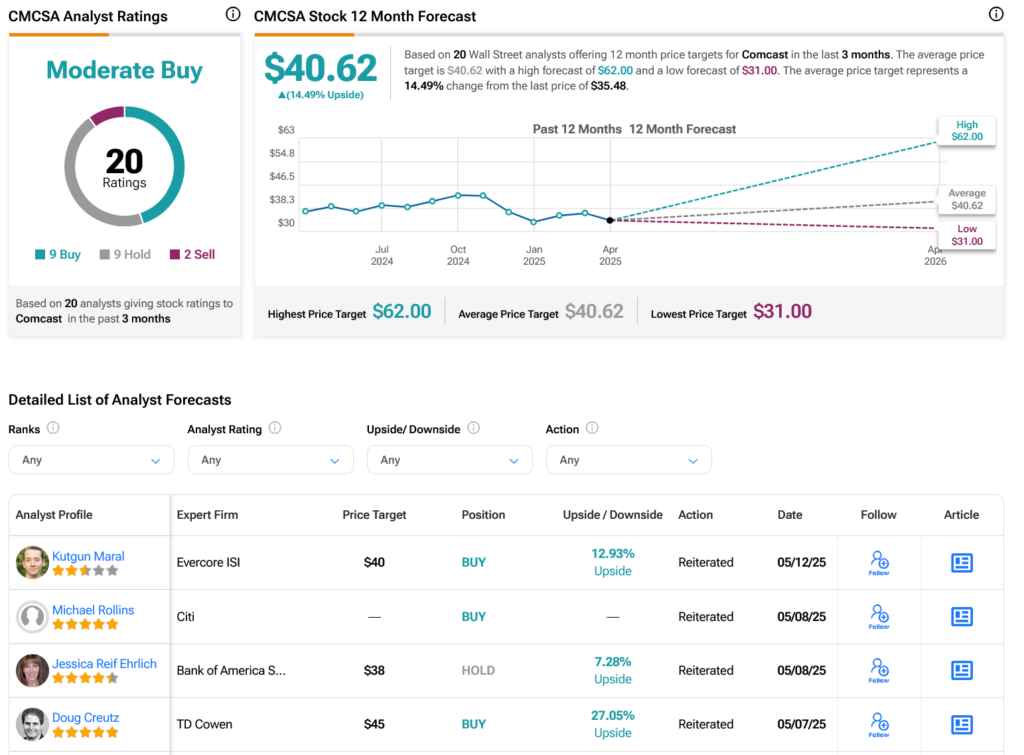

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CMCSA stock based on nine Buys, nine Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 8.49% loss in its share price over the past year, the average CMCSA price target of $40.62 per share implies 14.49% upside potential.

See more CMCSA analyst ratings

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue