Colgate-Palmolive stock (NYSE:CL) is now trading at an unjustifiably expensive valuation in today’s market environment. The consumer staples giant, renowned for household name brands like Colgate, Palmolive, Speed Stick, Ajax, and Hill’s Pet Nutrition, has seen notable share price gains in recent months. However, despite these increases, there have been no substantial changes to the company’s growth narrative, indicating potential downside risks ahead. Therefore, I maintain a neutral stance on the stock.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Q1 Results: Steady Revenue Growth, But Nothing Extraordinary

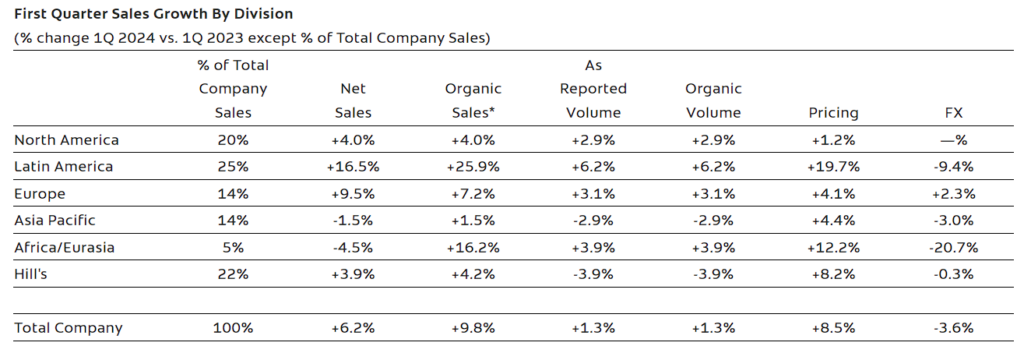

Colgate-Palmolive’s Q1 results showcased steady revenue growth. However, the quarter had nothing out of the ordinary to show that would justify the stock’s ongoing rally. Specifically, net sales grew by 6.2%, more or less in line with its five-year compound annual growth rate (CAGR) of 5.5%. Noteworthy is that revenues were impacted by a 3.6% foreign exchange headwind, offsetting an otherwise more impressive top-line growth rate of 9.8%.

However, even the near double-digit ex-FX organic growth requires some skepticism, as it was fully driven by higher prices, not higher sales volumes. In particular, Colgate-Palmolive registered 8.5% higher prices in the quarter, with sales volumes growing by just 1.3%. On the one hand, I can’t deny that this is a solid development. It showcases the inelastic nature of the company’s business model and the strength of its brands, which consumers are willing to pay a premium for during their everyday shopping

On the other hand, such significant price increases are unlikely to be sustainable in the long run. Today, the company might be successful in masking its continuous price hikes under the broader context of an inflationary environment. However, consumers will inevitably become dissatisfied with high single-digit price increases in essential items like toothpaste and hand soap, leading them to seek more affordable alternatives.

Margin Expansion May be Reaching the Finish Line

Another factor that has recently powered Colgate’s share price gains is a prolonged margin expansion trajectory. Yet, this trend may be reaching the finish line. The company has already seen five quarters of gross profit margin expansion, reaching 60% in Q1. Historically, this is where Colgate-Palmolive’s gross margin has topped and later stabilized. Given that the company’s pricing power tank may be running out of fuel, there is another reason to believe that the ongoing margin expansion story is about to end.

The Valuation Assumes Outstanding Growth Ahead

Shifting gears to the valuation, it seems the market is valuing the stock as if its revenue growth is going to be outstanding in the upcoming years. If not, maybe Wall Street thinks that the margin expansion story will last. However, as I just mentioned, I don’t think that this will be the case. Mainly due to Colgate-Palmolive having already exhausted its pricing power, in my view, none of these two stories are likely to play out.

In the meantime, Colgate-Palmolive’s valuation makes even less sense, given the current interest rate landscape. The stock is now trading at a forward P/E of 26.3x, near the very top of its 10-year historical average, which has hovered between 19 and 27 times earnings. With interest rates now at their highest over the past decade, this inverse relationship between valuation and rates is hard to explain.

Furthermore, at their current levels, shares are also attached to a very thin dividend yield of 2.1%. As a consumer staple giant, Colgate-Palmolive stock has historically been owned by conservative, income-oriented investors seeking a stable and growing income. Nonetheless, with rates now at 5%+, CL stock cannot compete with other fixed-income investors on a risk-adjusted basis.

The puzzling situation is that, despite rising interest rates, Colgate-Palmolive’s P/E ratio has not decreased as expected.

Is CL Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Colgate-Palmolive maintains a Strong Buy consensus rating despite an extended rally. This is based on 12 Buys and four Holds assigned in the past three months. At $97.87, the average CL stock forecast suggests 3.65% upside potential.

If you’re unsure which analyst you should follow if you want to buy and sell CL stock, the most accurate analyst covering the stock (on a one-year timeframe) is Andrea Faria Teixeira from JPMorgan (NYSE:JPM), with an average return of 11.62% per rating and a 90% success rate.

The Takeaway

In conclusion, while Colgate-Palmolive remains a strong player in the consumer goods space, delivering steady revenue growth, its current valuation appears overly optimistic, given the factors at play. Its sales expansion has been driven mainly by price increases rather than volume, while its margin expansion story may be reaching its peak. Coupled with a high P/E ratio and low yield in a high-interest-rate environment, the stock seems poised for downside risk.