Coinbase Global (COIN) shares are up in pre-market trading after the company announced a new investment in CoinDCX, one of India’s biggest crypto exchanges, valuing it at $2.45 billion. The move signals Coinbase’s growing interest in India’s fast-evolving digital asset market, despite a challenging tax and regulatory climate.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The investment builds on Coinbase’s earlier support for CoinDCX through its venture arm, Coinbase Ventures, which participated in a $135 million funding round in 2022 that valued the Indian platform at $2.15 billion. The latest deal marks Coinbase’s direct financial commitment to CoinDCX as it looks to expand its reach in India and the broader Middle East.

Coinbase Expands Its Footprint in Asia

Shan Aggarwal, Coinbase’s Chief Business Officer, said the company believes” India and its neighbors will help shape the future of the global on-chain economy.” The deal is still awaiting regulatory approval and other closing conditions.

Coinbase’s growing presence in India follows its registration with the Financial Intelligence Unit (FIU) in March — an important step toward offering crypto services under local rules. The move also fits with Coinbase’s push to grow outside the U.S. after facing tighter scrutiny in the U.S.

Is Coinbase a Buy, Sell or Hold?

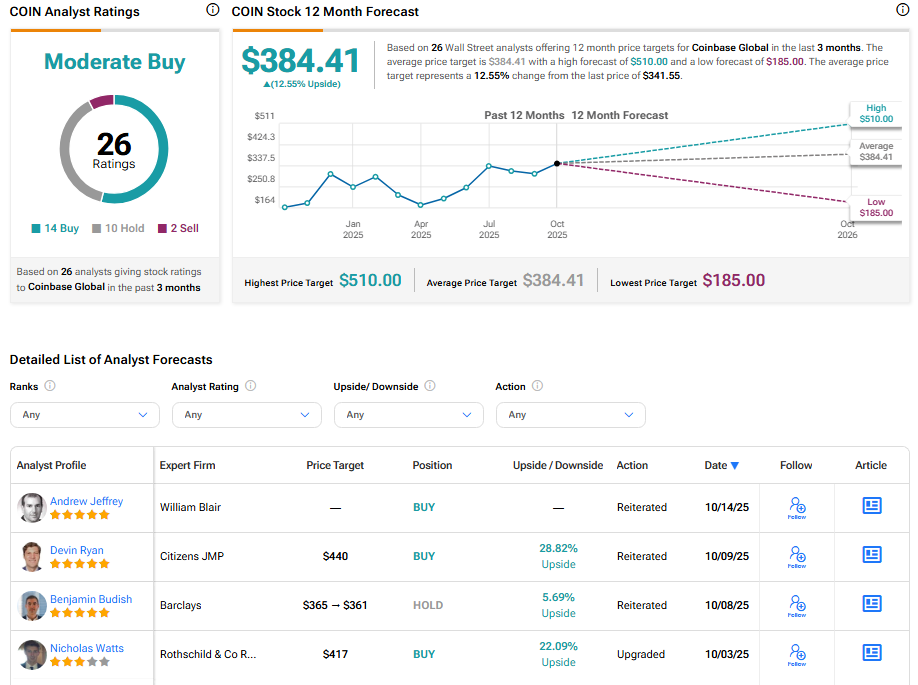

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on 14 Buys, 10 Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 73.96% rally in its share price over the past year, the average COIN price target of $384.41 per share implies 12.55% upside potential.