Cryptocurrency exchange platform, Coinbase Global (NASDAQ: COIN) gained in trading after the company’s losses narrowed in Q3 to $0.01 per share as compared to a loss of $2.43 per share in the same period last year. Analysts were expecting a loss of $0.39 per share.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

The company’s total revenues increased by 14.2% year-over-year to $674.1 million but fell short of analysts’ expectations of $678.4 million in the third quarter. Coinbase’s total trading volumes declined by more than 50% year-over-year to $76 billion.

Looking forward, management now expects fourth quarter subscription and services revenues to stay flat quarter-over-quarter and expects adjusted EBITDA in FY23 to be “meaningful positive.”

What is the Forecast for COIN Stock?

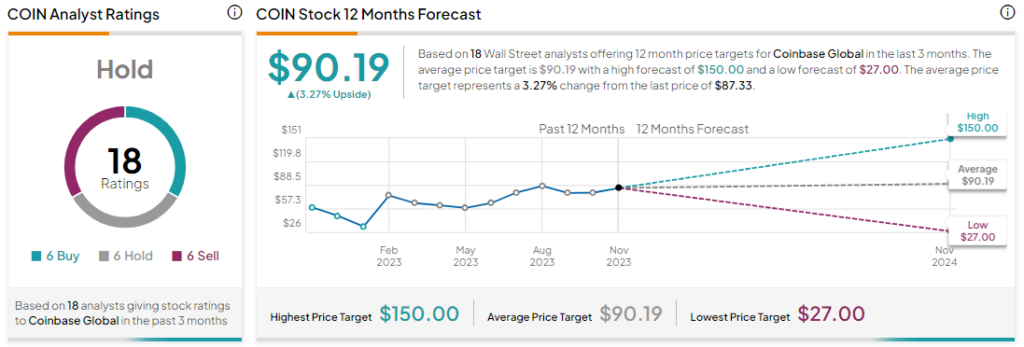

Analysts remain sidelined about COIN stock with a Hold consensus rating based on six Buys, Holds and Sells each. The average COIN price target of $90.19 implies an upside potential of 2.7% at current levels.