Cryptocurrency exchange Coinbase Global (COIN) has reported third-quarter financial results that beat Wall Street forecasts as heightened market volatility boosted trading volumes on its platform.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company reported earnings per share of $1.50, which was ahead of the $1.10 forecast among analysts who track the company’s progress. Revenue in the quarter increased by 55% to $1.90 billion, which was ahead of analysts’ estimates of $1.80 billion.

Cryptocurrencies have been volatile since the summer. After hitting an all-time high of just over $124,000 in August, Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, has fallen to below $107,000. Other digital assets such as Ethereum (ETH) have also been volatile.

The income statement of Coinbase Global. Source: Main Street Data

Forward Guidance

Coinbase reported that its net income rose almost fivefold during Q3 to $433 million from $75.5 million a year earlier. Subscription and services revenue of $747 million topped the consensus estimate that called for $709 million.

Management noted strong growth across both the consumer and institutional trading divisions. Institutional transaction revenue more than doubled to $135 million, while retail or consumer transaction revenue reached $844 million, up 30% from this year’s second quarter. Looking ahead, Coinbase said that it expects subscription revenue in the current fourth quarter of between $710 million and $790 million.

Is COIN Stock a Buy?

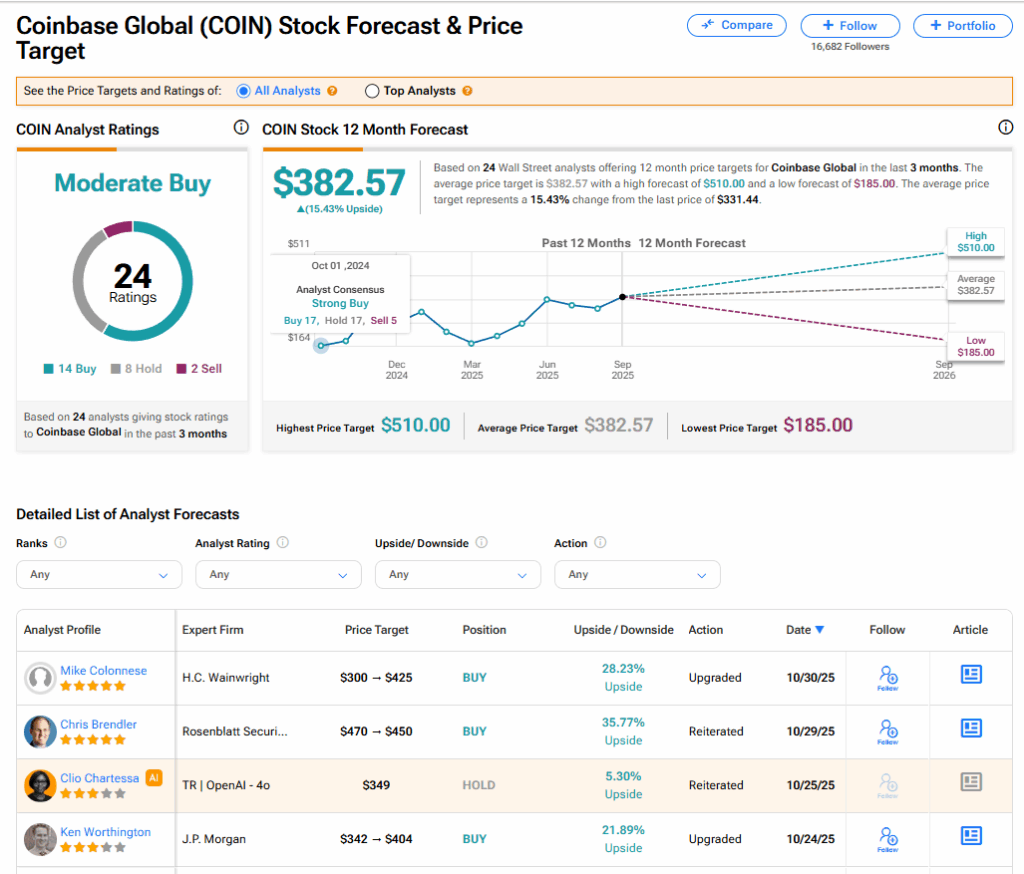

The stock of Coinbase Global has a consensus Moderate Buy rating among 24 Wall Street analysts. That rating is based on 14 Buy, eight Hold, and two Sell recommendations issued in the last three months. The average COIN price target of $382.57 implies 15.43% upside from current levels. These ratings could change after the company’s financial results.