Coca-Cola (KO) has been named the “Worst Plastic Polluter” by nonprofit conservation organization Oceana for the sixth year in a row. While that’s not an award the beverage company likely wanted to win, it does speak to its success.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

On one hand, Coca-Cola was granted the title of Worst Plastic Polluter as it generates more than 100 billion single-use plastic bottles annually. Looked at through a different lens, Coca-Cola is the top soda company in the U.S. thanks to the large demand for its products. The downside? Many of those plastic bottles end up in landfills.

Coca-Cola securing the top spot on a plastic pollution contest is no surprise. Its signature drink has the largest market share in the U.S. at 19%. On top of that, Sprite, another of the company’s sodas, was the third most popular U.S. soft drink at 8.03%. With more than a quarter of consumers preferring Coca-Cola’s products, the Worst Plastic Polluter moniker is a case of the company suffering from success.

Analysts Continue to Favor KO Stock

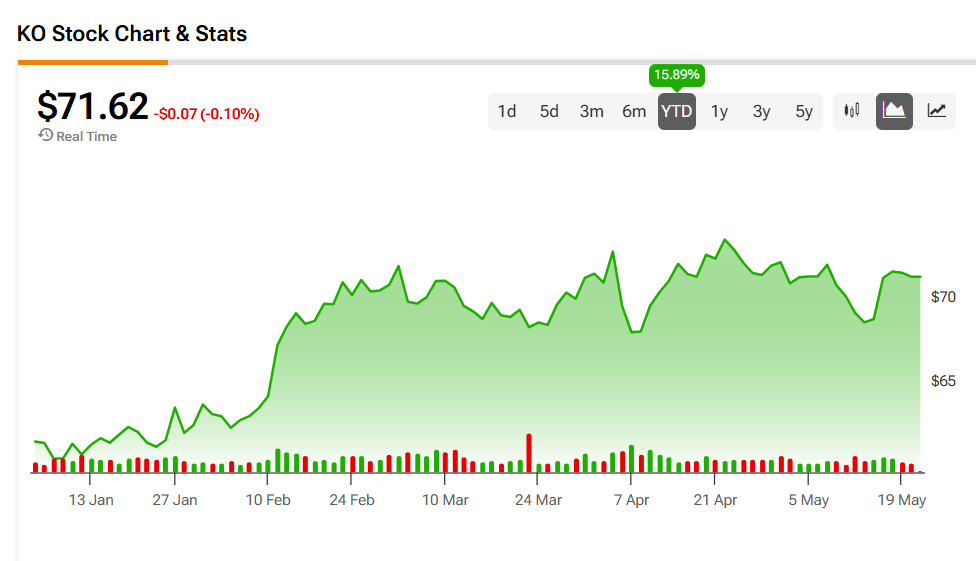

It’s no surprise that analysts largely love Coca-Cola stock. The company’s shares have rallied 15.89% year-to-date and are up 13.79% over the last 52 weeks. This resilience in the face of economic uncertainty has made it a favorite of analysts.

For example, Evercore ISI analyst Robert Ottenstein just reiterated a Buy rating and $80 price target for KO shares. That has the analysts expecting a potential 11.69% upside for the stock.

Is KO Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analyst’s consensus rating for Coca-Cola is Moderate Buy, based on 16 Buy and one Hold rating over the last three months. With that comes an average KO stock price target of $79.33, representing a potential 10.75% upside for the shares.