Comcast Corp. (CMCSA) reported mixed results for the second quarter. The company’s adjusted earnings for its second quarter came in at $1.21 per share, up by 7% year-over-year, which beat analysts’ consensus estimate of $1.09 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CMCSA’s Studios See a Drop in Revenue

However, the media giant’s revenues declined by 2.7% year-over-year to $29.68 billion in the second quarter and missed analysts’ expectations of $31.7 billion. The company’s revenues were dragged down by declining sales at theme parks and lower revenues from its movie studios.

Comcast’s revenue from studios dropped 27% to $2.25 billion in the second quarter. Despite last year’s hits like The Super Mario Bros. Movie and Fast X, Universal Studios lacked a comparable blockbuster this quarter.

Comcast’s Theme Parks Are Struggling

Although the company’s parks business rebounded since the pandemic, customers are now exploring other entertainment options like international travel and cruises. However, this shift has coincided with Comcast’s new attractions getting delayed and the rescheduling of its Epic Universe theme park to 2025. The company’s Theme Parks revenue fell 11% year-over-year to $1.98 billion, missing analysts’ forecast of $2.21 billion, while Film and TV sales were $2.25 billion, below the consensus estimates of $2.51 billion.

According to the TipRanks “Bulls Say, Bears Say,” analysts bearish about CMCSA stock have attributed the weak theme park results and outlook to “factors like the Covid pull forward of demand, lack of new attractions in the U.S., and tough comparisons.”

Comcast’s Business Segment Performance

Comcast’s Connectivity business is its largest business segment, which saw its revenues decline by 0.7% year-over-year to $20.24 billion. This business segment’s adjusted EBITDA rose 1.6% to $8.48 billion in the second quarter, surpassing Wall Street forecasts due to cost efficiencies and 322,000 new wireless customers.

However, Comcast’s Xfinity Broadband business lost 120,000 customers due to increased competition and 419,000 video subscribers as people switched to streaming. The company’s Peacock streaming service reported 33 million subscribers, up 38% year-over-year but below the Street forecast of 34.7 million.

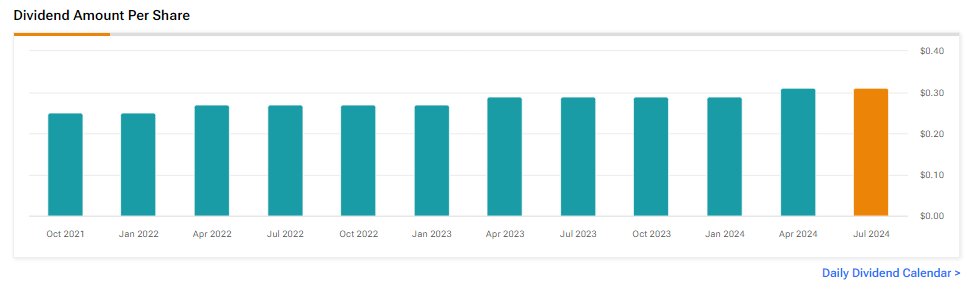

Comcast’s Dividend and Stock Buyback

Comcast announced that its Board of Directors declared a quarterly dividend of $0.31 per share, payable on October 23 to shareholders of record as of the close of business on October 2, 2024. During the second quarter, the company returned a total of $3.4 billion to shareholders. This included stock buybacks of $2.2 billion and dividend payments of $1.2 billion.

Is CMCSA a Buy or Sell?

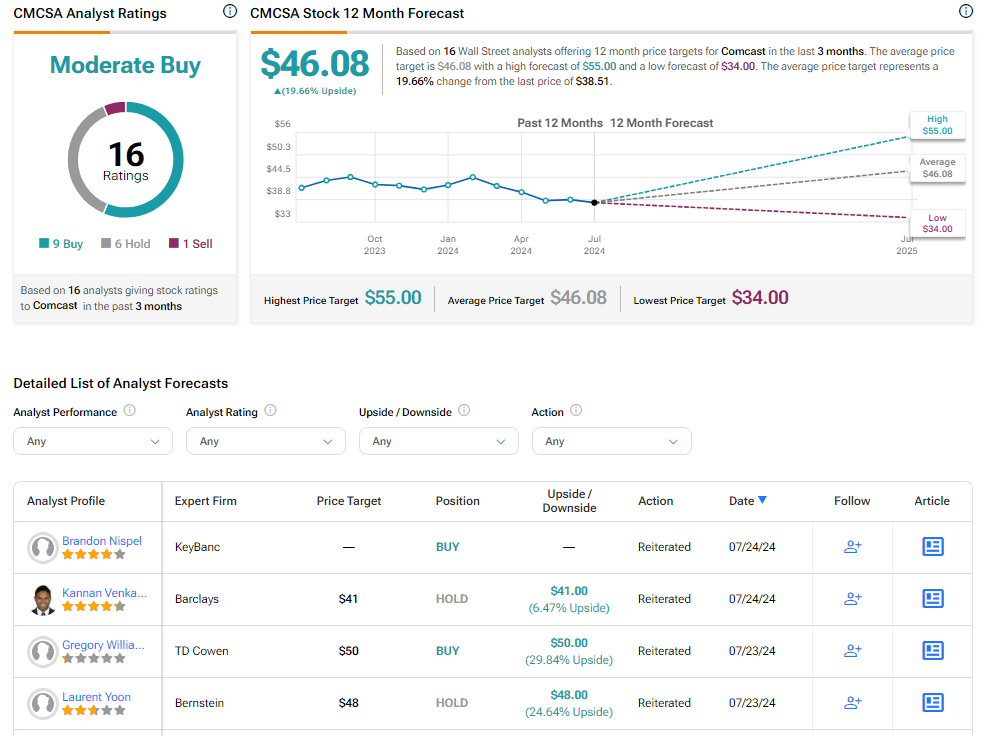

Analysts remain cautiously optimistic about CMCSA stock, with a Moderate Buy consensus rating based on nine Buys, six Holds, and one Sell. Year-to-date, CMCSA has declined by more than 10%, and the average CMCSA price target of $46.08 implies an upside potential of 19.6% from current levels.