Comcast (NASDAQ:CMCSA) reported strong Q1 earnings, with adjusted earnings of $1.04 per share, indicating double-digit growth of 13.9% year-over-year. This exceeded consensus estimates of $0.99 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The media and entertainment conglomerate generated Q1 revenues of $30.06 billion, up by 1.2% year-over-year, beating analysts’ estimates of $29.8 billion. Despite losing 65,000 customers in the U.S. broadband business in Q1, Comcast saw a 4.2% growth in the domestic broadband average rate per customer due to higher rates. Additionally, Comcast’s domestic wireless business gained 6.9 million customers in Q1, marking a 21% increase year-over-year.

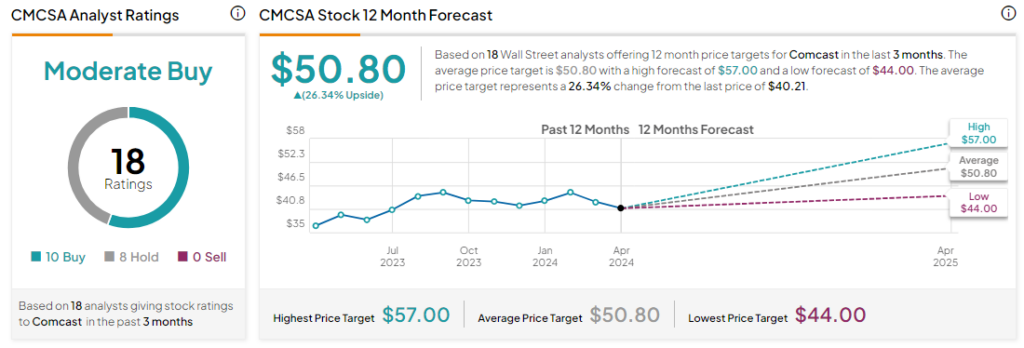

Is CMCSA a Buy or Sell?

Analysts remain cautiously optimistic about CMCSA stock, with a Moderate Buy consensus rating based on 10 Buys and eight Holds. Over the past year, CMCSA has increased by more than 10%, and the average CMCSA price target of $50.80 implies an upside potential of 26.3% from current levels. These analyst ratings are likely to change following CMCSA’s Q1 results today.