Shares of Cleveland-Cliffs (NYSE:CLF) slipped in after-hours trading after the company reported earnings for its fourth quarter of Fiscal Year 2023. Earnings per share came in at -$0.05, which was in line with analysts’ consensus estimate. Sales increased by 1.4% year-over-year, with revenue hitting $5.11 billion. This missed analysts’ expectations by $40 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

For the full year, the company reported steel shipments totaling 16.4 million net tons, notably setting a record in the automotive sector. The firm posted an adjusted EBITDA of $1.9 billion, coupled with a robust cash flow of $2.3 billion and free cash flow of $1.6 billion. In addition, it reduced its net debt to $2.9 billion.

Looking forward, management is forecasting a $30 per net ton reduction in steel unit costs for 2024. Additionally, Cliffs expects its capital expenditures to be between $675 and $725 million.

Is CLF Stock a Buy or Sell?

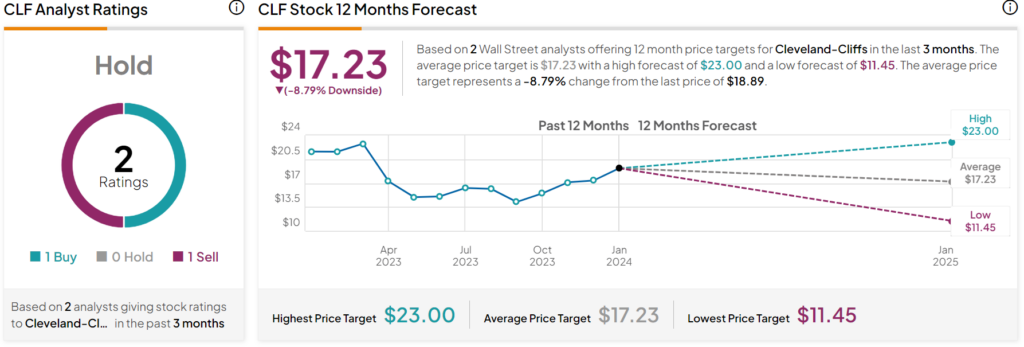

Turning to Wall Street, analysts have a Hold consensus rating on CLF stock based on one Buy, zero Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 7% rally in its share price over the past six months, the average CLF price target of $17.23 per share implies 8.79% downside risk.