Cleveland-Cliffs (CLF) stock fell Friday after it was reported the company will temporarily idle two factories in Minnesota, resulting in hundreds of layoffs.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Minnesota Star Tribune reported that CLF would shutter its plants at Hibbing and the Minorca Mine in Virginia. The Ohio-based company, which is the largest producer of flat-rolled steel in North America, said the closures were “necessary to rebalance working capital needs and consume excess pellet inventory produced in 2024,” according to a statement seen by the newspaper.

Auto Industry Hit by Tariffs

Both plants produce steel pellets used in the auto industry, which has been shaken up by President Donald Trump’s tariffs. While domestic steel producers may benefit from a 25% tariff on imported steel, the disruption from tariffs on China, Mexico and Canada has created all kinds of problems for one of the key buyers of finished steel: the auto industry.

While Trump granted U.S. automakers a one-month exemption on tariffs on imports from Mexico and Canada, analysts have raised concerns about the impact trade wars will have on the auto supply chain.

Piper Sandler downgraded Chrysler-owner Stellantis (STLA) yesterday, citing “too much political uncertainty” in the auto manufacturing supply chain. Trump has reiterated that “reciprocal tariffs” will go ahead on April, which will create extended disruption to the auto industry and leave industry planning in a “virtual gridlock,” according to S&P Global. This in turn could leave steel producers facing a pause in orders from automakers.

Shares of CLF dipped more than 3% on Friday on the report. CLF stock initially started the year on the front foot but has declined about 20% since peaking in the middle of February.

Is CLF a Good Buy?

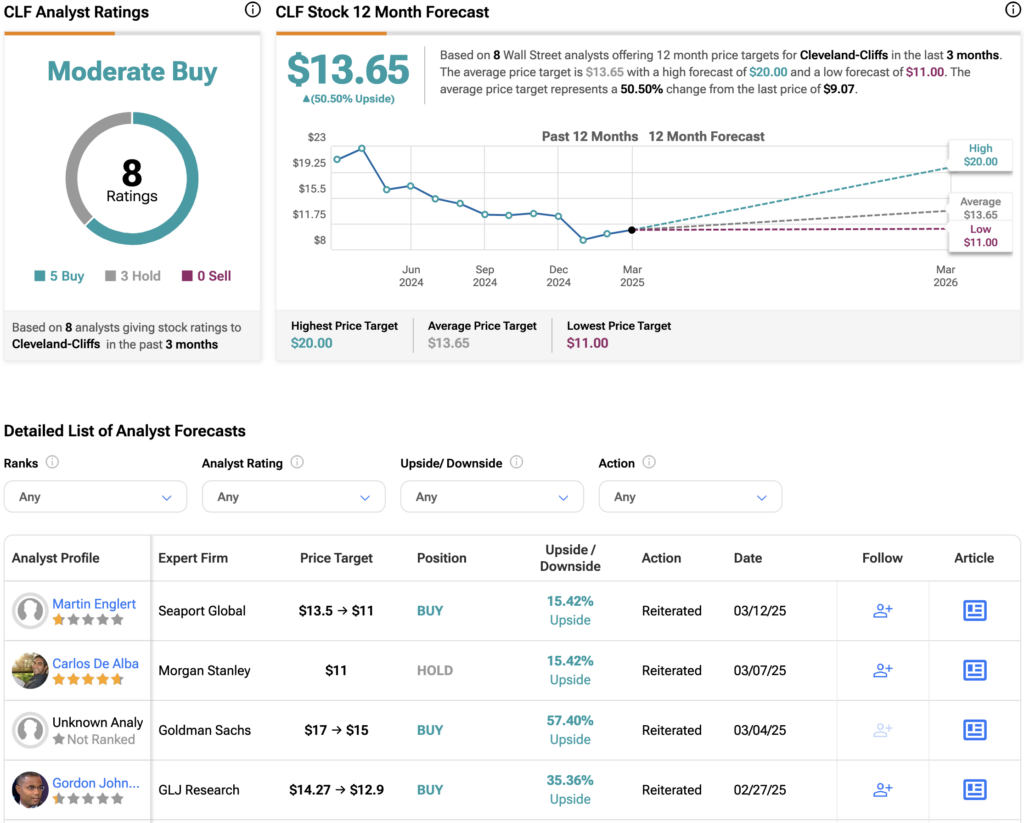

On Wall Street, analysts have a Moderate Buy consensus rating on CLF stock, based on five Buys and three Holds. The average CLF price target of $13.65 implies about 43% upside.