Citi’s top analyst, Atif Malik, sees limited impact from the potential 25% tariffs on Apple’s (AAPL) business, should the iPhone maker continue manufacturing its devices in India. President Donald Trump has threatened Apple of at least 25% tariffs if the company does not manufacture all the products sold in the U.S. domestically. However, despite repeated warnings, both Apple and its key Taiwanese supplier, Foxconn, are continuing to expand their operations in India.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

After evaluating the full impact of the proposed 25% tariffs on all of iPhone imports to the U.S., Malik reiterated his “Buy” rating on AAPL stock. He also maintained his previous price target of $240 on AAPL, which implies 22.9% upside potential from current levels.

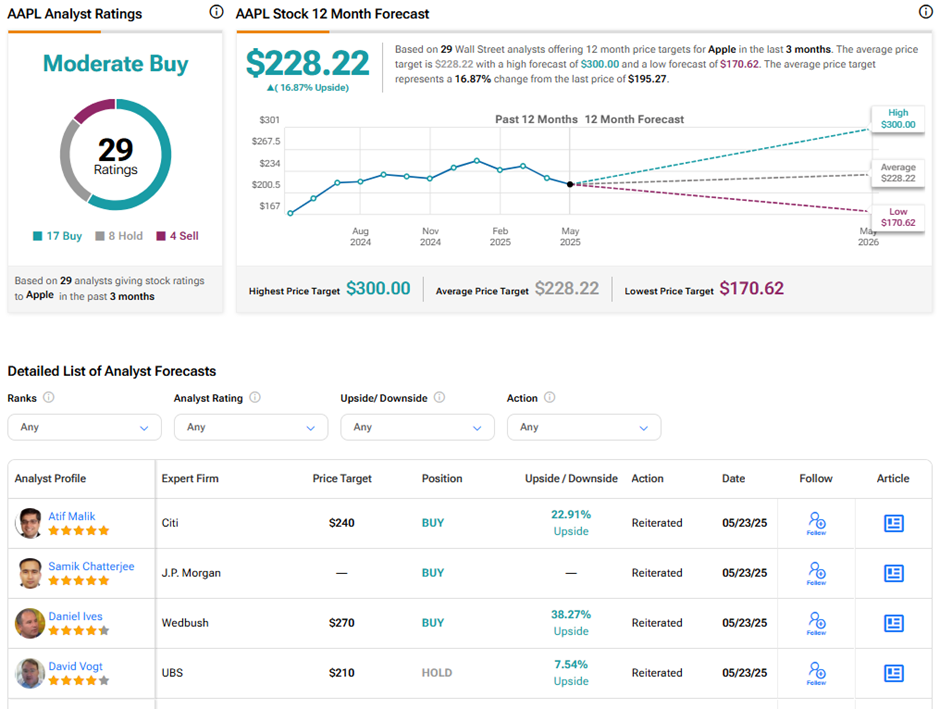

Malik is a five-star analyst on TipRanks, ranking #19 out of 9,562 analysts covered. He boasts an impressive success rate of 68% and an average return per rating of 27.90%.

Malik Is Bullish on AAPL Despite Tariff Concerns

Malik estimated the full impact of the proposed 25% tariffs on iPhone imports and found limited downside. He assumed a 25% tariff as the bear case on all iPhone imports, which account for two-thirds of Apple’s U.S. imported products. His calculation shows a 130-basis-point incremental impact on Apple’s gross margin, or a 4% incremental earnings per share (EPS) impact in fiscal year 2026.

Meanwhile, his base case scenario includes a 20% tariff on China and a 10% tariff on India. Additionally, Malik assumes that Apple will pass on one-third of the incremental costs to consumers and/or suppliers.

According to data compiled by Main Street Data, Apple’s gross margins have remained steady or increased modestly over the past few years. In the trailing twelve months ending March 31, 2025, Apple’s gross margins stood at a healthy 46.63%, with revenue totaling $400.37 billion.

To conclude Malik’s views, considering Apple’s healthy revenues and gross margins, the proposed 25% tariffs could have a limited and manageable impact on its business. Hence, Malik remains highly bullish on Apple stock and has assigned a favorable price target.

Is Apple Stock a Buy, Hold, or Sell?

Not all analysts share the same enthusiasm about Apple’s long-term stock trajectory. On TipRanks, AAPL stock has a Moderate Buy consensus rating based on 17 Buys, eight Holds, and four Sell ratings. Also, the average Apple price target of $228.22 implies 16.9% upside potential from current levels. Year-to-date, AAPL stock has lost 21.8%.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue