Citigroup (C) is cutting its Russia ties for good. The bank’s board has approved the sale of its remaining Russian operations, taking a $1.2 billion loss. As part of the deal, Citigroup plans to sell AO Citibank, its final Russian business unit, to Renaissance Capital. The move removes a long-standing overhang and could help set the stage for a cleaner growth story ahead.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While the big loss sounds negative at first, many investors are focused on the bigger picture: the move removes a long-standing risk, reduces uncertainty, and simplifies the bank’s operations. By closing this chapter, Citi can redirect capital and management attention toward more profitable core businesses, which could support steadier growth over time.

More Details on Citigroup’s Russian Exit

In a filing with the Securities and Exchange Commission, the bank said it will classify its remaining Russian operations as “held for sale” as of the fourth quarter of 2025. The transaction is expected to close in the first half of next year, subject to regulatory approvals.

Meanwhile, Citigroup stated that the approvals will lead to a pre-tax loss from the sale in the fourth quarter of 2025. Most of that loss is due to currency-related adjustments, which will stay on the bank’s balance sheet until the deal officially closes.

Citi further stated that the combined impact of these moves will not affect its core capital levels. In simple terms, the bank expects its key capital ratio (CET1) to remain unchanged. Citi also noted that the final loss from the sale could still change, mainly because currency exchange rates may move before the deal is completed.

Citi’s Russian Overhang

Citigroup first announced plans to scale back its presence in Russia in August 2022, saying it would wind down its consumer and local commercial banking businesses as part of a broader effort to reduce exposure in the country.

Last month, Russian President Vladimir Putin approved Renaissance Capital’s purchase of Citibank’s Russian operations.

Is Citigroup a Good Stock to Buy Now?

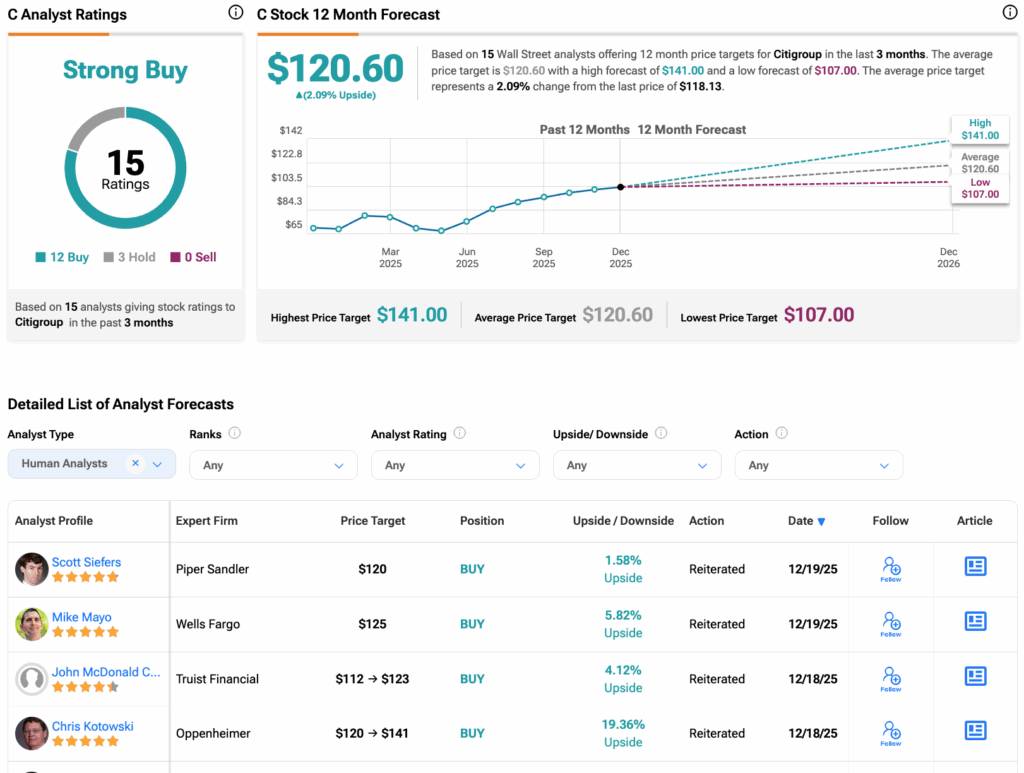

On TipRanks, C stock has a consensus Strong Buy rating among 15 Wall Street analysts. That rating is based on 12 Buys and three Holds assigned in the last three months. The average Citigroup stock price target of $120.60 implies a 2.09% upside from current levels.