Nvidia (NASDAQ:NVDA) continues to operate from a position of strength, steadily extending its reach across the AI stack. The company’s recent pseudo-acquisition of Groq fits that pattern.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Under a non-exclusive licensing agreement reportedly valued at $20 billion, Nvidia gains access to Groq’s inference technology. In addition, Groq’s founder, president, and several key team members will join Nvidia, bringing technical expertise along with the IP.

Nvidia’s chips are widely acknowledged as the best and brightest when it comes to training AI datasets. However, in the world of inference, NVDA doesn’t enjoy quite the same level of dominance. The move to integrate Groq’s inference abilities into the Nvidia ecosystem was seen as an effort to expand its industry-leading moat in this dimension as well.

How should investors view the deal? Wall Street is overwhelmingly positive when it comes to Nvidia, and this agreement hasn’t changed the bullish mood one bit. For instance, both Citigroup and UBS reiterated positive views following the announcement.

Top UBS analyst Timothy Arcuri – who is among the top 1% of Wall Street pros – deemed the move astute indeed, positing that it “could bolster NVDA’s ability to service high speed inference applications, an area where GPUs are not ideally suited because of all the off chip HBM (high bandwidth memory).”

The 5-star analyst explains that Groq’s LPU (language processing units) technology specializes in high-speed inference and is effective at resolving latency issues with GPUs. Further supporting the move, Arcuri points out that Groq is especially well-suited to help address this challenge.

“Our own discussions with hyperscale experts over the past year suggested that many saw Groq’s offering as highly differentiated, frequently singled out among other accelerator startups,” adds Arcuri.

No surprise here, UBS expects further share price appreciation in the year ahead, which should be driven mostly by upwards EPS revisions. Arcuri assigns NVDA a Buy rating, and his price target of $235 implies future gains of some 24%. (To watch Arcuri’s track record, click here)

Citi is singing from the same hymn sheet. 5-star analyst Atif Malik, who is also among the top 1% of Wall Street experts, calls the deal “a clear positive,” underscoring his confidence in Nvidia’s trajectory.

Malik likes the fact that Nvidia is acknowledging the importance of specialized inference architecture, especially when it comes to “real-time and cost-efficient AI deployments.” Taking the initiative to bring Groq inside should help Nvidia head off potential competition from TPUs and even startups.

“By licensing Groq’s IP, Nvidia can swiftly add more inference-optimized compute stacks to its road map without building the technology from the ground up,” explains Malik, who adds that the licensing arrangement should help the company avoid regulatory hiccups.

The analyst expects hyperscale inference demand to double every six months, providing no shortage of opportunity for NVDA to keep on rolling in the year ahead.

To this end, Malik is reiterating a Buy rating on NVDA shares, and his $270 price target would translate into gains north of 40%. (To watch Malik’s track record, click here)

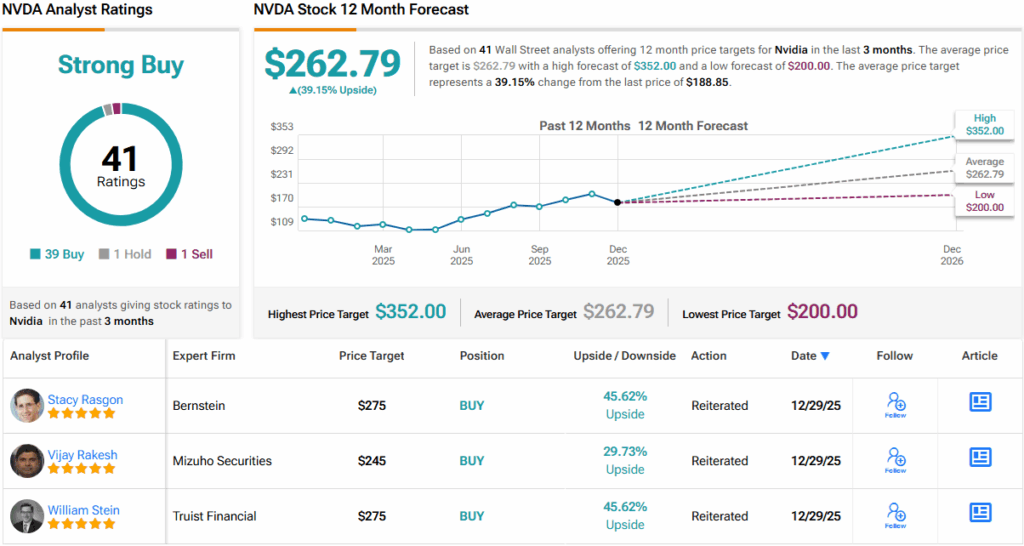

Overall, Nvidia continues to sit firmly at the top of Wall Street’s buy lists, backed by an overwhelming 39 Buys versus just 1 Hold and 1 Sell. The stock carries a Strong Buy consensus rating, and the Street’s 12-month average price target of $262.79 implies 39% upside heading into 2026. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.