Citigroup (C) recently reported its Q2-2024 earnings results, which I’ll discuss in detail. In a nutshell, the bank is making good progress toward higher revenues and lower expenses for the full year, but profitability remains an issue due to elevated credit losses. Nevertheless, I believe the shares are worth a Buy rating, as the company has the potential to improve profitability even with the prospect of lower interest rates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

My bullish case rests on an attractive tangible book discount (tangible book value of $87.53 compared to a $63.97 share price), which provides a sizable margin of safety relative to the valuations of large peers such as Bank of America (BAC) and Wells Fargo (WFC). These peers performed worse than Citigroup in the recent Federal Reserve stress tests.

Citigroup Operational Overview

Citigroup reports results in six main operating segments: U.S. Personal Banking at 23.8% of Q2-2024 revenues, Services at 23.4%, Markets at 24.6%, Wealth at 9.1%, Banking at 6.1%, and All Other (Managed Basis), which includes former Legacy Franchises, global staff functions, corporate treasury, etc., at 13%. Let’s analyze how these major segments performed.

U.S. Personal Banking managed to grow sales by 6% year-over-year, an impressive result considering operating costs were 2% lower year-over-year. Moving down the income statement, the picture becomes bleaker, as credit losses were a stunning 59% higher year-over-year, driven in large part by credit cards. On a more positive note, part of the elevated credit losses were due to a precautionary reserve build rather than actual losses. Nevertheless, the return on tangible common equity (RoTCE) was a paltry 1.9%, making it the least profitable segment for the bank.

Services grew its topline by 3% year-over-year, a mediocre performance considering operating costs shot up 9% year-over-year. This was more than offset by a benign credit environment characterized by provision releases, which pushed the RoTCE to 23.8%, making Services the most profitable segment for the bank.

Markets delivered 6% year-over-year revenue growth, which, coupled with a 1% year-over-year decrease in operating expenses and provision releases, boosted RoTCE to 10.7% for the quarter.

Wealth managed to achieve 2% higher revenues year-over-year against the backdrop of solid cost control (operating costs were 4% lower year-over-year) and a benign credit environment characterized by provision releases. This pushed the RoTCE to 6.4% for the quarter, still the second-worst performing business for Citigroup.

Banking revenue shot up 38% year-over-year on the strength of investment banking. Cost control was equally impressive as operating costs were 10% lower year-over-year. The combined effect, coupled with provision releases, helped push the RoTCE to 7.5%.

All Other (Managed Basis) delivered a $402 million net loss, with revenues declining faster than expenses and credit costs remaining high.

For the bank as a whole, revenues were 4% higher year-over-year, while operating expenses decreased 2% year-over-year. Credit losses were 36% higher year-over-year, driven by actual credit losses rather than a precautionary reserve build. Overall, the RoTCE came in at 7.2% (up from 6.4% in Q2 2023), while tangible book value increased 1% quarter-over-quarter to $87.53 per share. Earnings per share (EPS) was $1.52, up 14% year-over-year. It is noteworthy that Citigroup’s results included a one-off $400 million gain related to the Visa B exchange.

After outlining the bank’s Q2-2024 results, I can conclude that Citigroup managed to grow revenues and keep expenses in check, as outlined in its 2024 plan. However, profitability remains quite low, impacted by elevated credit losses and the lingering impact of legacy businesses. We should note that restructuring expenses were insignificant in the quarter, implying that going forward, profitability improvement should come primarily from lower credit losses.

Citigroup’s Capital Position

Citigroup strengthened its capital position in Q1 2024. Its CET1 ratio (which measures a bank’s capital relative to its assets) improved to 13.6% at the end of the quarter, up 0.1% quarter-over-quarter, as the bank distributed only 34% of the net income generated during the quarter to shareholders. The 13.6% CET1 ratio represents a 1.3% buffer relative to the 12.3% regulatory requirement. Citigroup will further benefit from business exits in recent years, with the requirement set to drop to 12.1% in October 2024.

These developments allow Citigroup to allocate $1 billion for share repurchases in Q3 2024.

Citigroup Performance on Stress Tests

The 2024 Federal Reserve Stress Tests showed that Citigroup would perform better than major peers such as Bank of America and Wells Fargo. Under the stress test scenario, Citigroup’s capital ratio would fall to 9.7%, marginally above Bank of America’s at 9.1% and well above Wells Fargo’s at 8.1%. This is quite impressive, considering Citigroup trades at a roughly 50% lower price-to-book multiple compared to Bank of America and Wells Fargo. As a result, in a potential downturn like the one envisioned in the stress test scenario, Citigroup shares may outperform some of its biggest peers.

Navigating Interest Rate Outlook

Current futures pricing indicates an equal chance that in July 2025, the interest rate set by the Federal Reserve (known as the Fed funds rate) will be either 3.75-4.00% or 4.00-4.25%. Either way, markets predict at least five 0.25% rate cuts over the next twelve months. This will pressure Citigroup’s net interest income and make it harder for the bank to reach its 11-12% medium-term RoTCE target.

Nevertheless, the bank still has room to improve its profitability irrespective of interest rates, largely dependent on exiting its remaining legacy businesses (most notably in Mexico) and seeing its credit card losses normalize. As such, I maintain my Buy rating, with the caveat that the bank may be dragged down by sector-wide weakness if bank profitability takes a hit from lower interest rates across the board. One way to mitigate that risk would be to complement your Citigroup position with covered call selling, as I see no quick fix for the bank’s persistent lackluster profitability. Instead, RoTCE should only improve gradually over the next few years.

Is Citigroup Stock a Buy, According to Analysts?

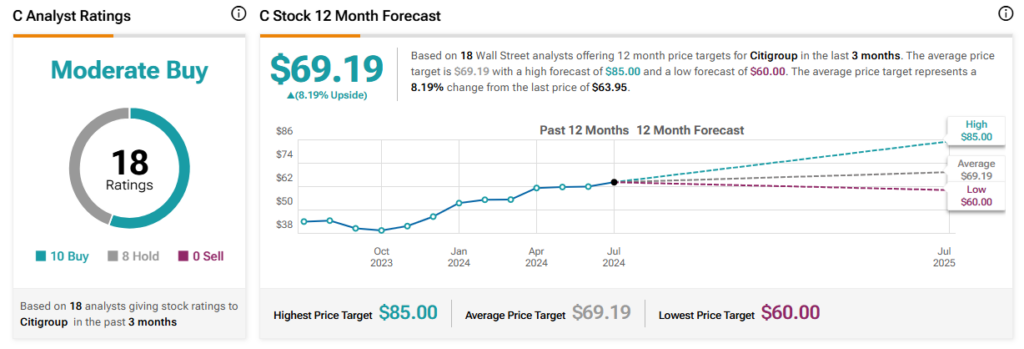

Turning to Wall Street, Citigroup earns a Moderate Buy consensus rating based on ten Buys, eight Holds, and zero Sell ratings assigned in the past three months. Additionally, Citigroup stock’s average price target is $69.19, implying an 8.19% upside potential.

Key Takeaway

Citigroup delivered a robust Q2 2024 operational performance, managing to grow revenues while keeping costs in check. The bank scored equally well on the Federal Reserve’s 2024 stress tests and is set to benefit from lower capital requirements later in the year. Profitability, however, remains an issue, and the prospect of lower interest rates will not help the bank reach its 11-12% RoTCE target any time soon. Nevertheless, this is already well discounted in the share price as it continues to trade at a significant discount to peers. As a result, I maintain my Buy rating.