Citigroup (C) is set to report Q3 2024 earnings on October 15. Analysts expect the bank to deliver earnings of about $1.31/share on revenue of about $19.83 billion. I think these expectations are quite conservative and believe that the bank is set to outperform consensus estimates when it reports next week.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I am bullish on the bank’s prospects as profitability should improve in 2025 and 2026 on the back of stabilizing U.S. unemployment and a smaller negative drag from legacy franchises. These positive effects are likely to be partially offset by interest rate cuts by the Federal Reserve.

Citigroup Q3 2024 Earnings Preview

Citigroup reports results for six main operating segments: U.S. Personal Banking (23.8% of Q2-2024 revenues), Services (23.4%), Markets (24.6%), Wealth at (9.1%), Banking (6.1%), and “All Other”-Managed Basis (13%) which includes former Legacy Franchises, global staff functions, corporate treasury, etc.. Let’s examine how these business segments should perform in Q3 2024, and why I’m bullish.

U.S. Personal Banking should finally see some relief on the credit costs side as the U.S. unemployment rate peaked at 4.3% early in Q3 2024 and declined to 4.1% towards the quarter end. That said, profitability as measured by the return on tangible common equity (RoTCE) will remain an issue but I expect it to improve from the 1.9% RoTCE observed in Q2 2024.

I anticipate Services, Markets, Wealth, and Banking to continue their Q2 2024 trend of robust year-over-year revenue growth, with strength concentrated in Banking as the outlook for Fed policy normalization has resulted in increased activity in the investment banking sector.

All Other (Managed Basis) should remain a drag on performance as there were no major announcements on asset sales during the quarter. For reference, this reporting segment posted a $402 million loss in Q2 2024.

I expect some 63% of the bank’s revenue comes from segments exhibiting robust operating performance, while the remaining 37% will only show gradual but still positive improvements.

Citigroup Q3 Estimates

For the bank as a whole, analysts expect Q3 earnings of about $1.31/share on revenue of about $19.83 billion. The top-line estimate would represent a revenue decline of 1.3% Y/Y. While the prior-year quarter did include a $396 million positive impact on revenue from divestitures, I believe the consensus revenue estimate is too conservative. Instead, I anticipate Citigroup’s revenue will land at about $20.4 billion for the quarter.

The $1.31/share earnings estimate also seems low as it would only represent a RoTCE of about 6%. It is worth noting year-over-year EPS comparisons will not be very useful given one-off gains in the prior year quarter. Still, I expect RoTCE to come in at around 7% or more, with earnings likely exceeding $1.50/share.

My rationale for the approximately $1.50/share in EPS for Q3 2024 rests in accretive buybacks which I expect Citigroup conducted as the company’s shares were under pressure throughout the quarter. Furthermore, I anticipate profitability in the U.S. Personal Banking division to pick up as Q2 2024 results reflected a precautionary reserve build as well as actual charge-offs. With U.S. unemployment stabilizing, provisioning should only reflect actual credit losses going forward.

All in all, analyst consensus estimates seem too conservative going into Citigroup’s Q3 2024 earnings, and the bank may well repeat its top-and-bottom line beat that it achieved in Q2 2024.

Citigroup’s 2025 and 2026 Outlook

U.S. unemployment is running close to the Fed’s 4.2% long-term outlook for the U.S. economy. This implies Citigroup should see a diminishing effect from credit losses in its U.S. Personal Banking business, which is destined to be one of the key profit drivers over the medium term. At the same time, the bank is set to continue reducing the size of its legacy businesses classified in the All Other (Managed Basis) segment. This should also boost the bank’s aggregate profitability.

These positive effects are likely to be somewhat offset from interest rate cuts by the Federal Reserve. U.S. interest rates remain well above the Fed’s estimated 2.9% neutral rate despite stabilizing inflation and unemployment. Net interest income accounted for 67% of the bank’s Q2 2024 revenue, making Citigroup quite exposed to changes in interest rates.

My rationale for a negative impact from lower short-term interest rates on Citigroup is twofold. First, the bank’s revenue on floating rate loans should be immediately lessened by a reduction in the secured overnight financing rate (SOFR). SOFR is a common benchmark for floating rate debt which closely tracks the Fed funds rate set by the Federal Reserve. At the same time, funding costs in terms of certificates of deposit, preferred stock, and bonds issued by Citigroup tend to be fixed-rate and take more time to reprice lower. The other impact on Citigroup’s net interest income will come from lower interest rates it receives for cash parked at the Federal Reserve overnight.

The combined result of these profit drivers, in my view, should be a gradual uptick in RoTCE towards the bank’s 11-12% medium-term objective. However, I do not see that profitability target being attained in 2025 given current performance trends.

Is Citigroup Stock a Buy, According to Analysts?

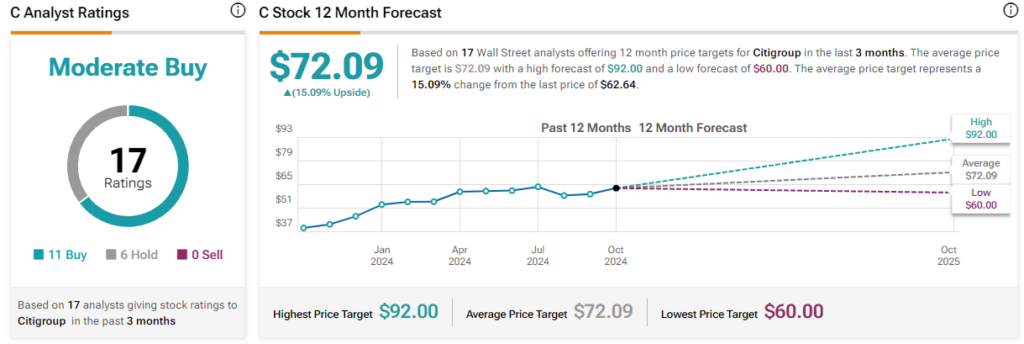

Turning to Wall Street, Citigroup earns a Moderate Buy consensus rating on TipRanks based on eleven analyst Buy ratings, and six Hold ratings. There were no Sell ratings assigned on Citigroup stock in the past three months. Additionally, the average C price target is $72.09, implying ~15 potential upside.

Summary & Takeaway

Citigroup is set to report earnings next week, with my baseline expectations tracking for a beat on consensus revenue and EPS estimates. Even so, profitability will likely remain under pressure as the bank grapples with elevated credit costs in its U.S. Personal Banking segment, as well as a negative contribution from legacy franchises.

Looking ahead to 2025 and 2026, the factors that subdued Citigroup’s profitability are likely to subside – the U.S. unemployment rate should stabilize around current levels, while the bank looks set to exit the remaining legacy franchises. This should help Citigroup overcome the effect of lower Fed interest rates and put it on a path to reaching its 11-12% RoTCE objective in 2026 and beyond. As such I recommend buying the shares.