Citigroup (C) is set to cut about 1,000 jobs this week as CEO Jane Fraser continues her plan to lower costs and improve the bank’s performance. People familiar with the matter told Bloomberg that the layoffs are part of a larger plan announced two years ago to eliminate 20,000 jobs by the end of 2026. Citigroup had 227,000 employees at the end of September.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Since becoming CEO in 2021, Fraser has been working to simplify and streamline the bank by selling off much of Citi’s international retail business and restructuring its main operations. In a statement, Citigroup said it will continue reducing headcount in 2026 as it adjusts staffing levels, uses more technology, and moves forward with its transformation plans. This is a busy week for the bank, as it is also set to report full-year earnings and announce employees’ 2025 bonus amounts.

Looking ahead, CFO Mark Mason previously said that Citi expects its workforce to fall to about 180,000 employees by 2026, which includes 40,000 jobs that will disappear when its Mexican retail unit, Banamex, is spun off through an IPO. That means Citi will still need to cut several thousand more jobs and complete the Banamex listing to hit its goal. However, shares dropped 3% on Monday after President Donald Trump called for a cap on U.S. credit card interest rates.

Is Citigroup Stock a Good Buy?

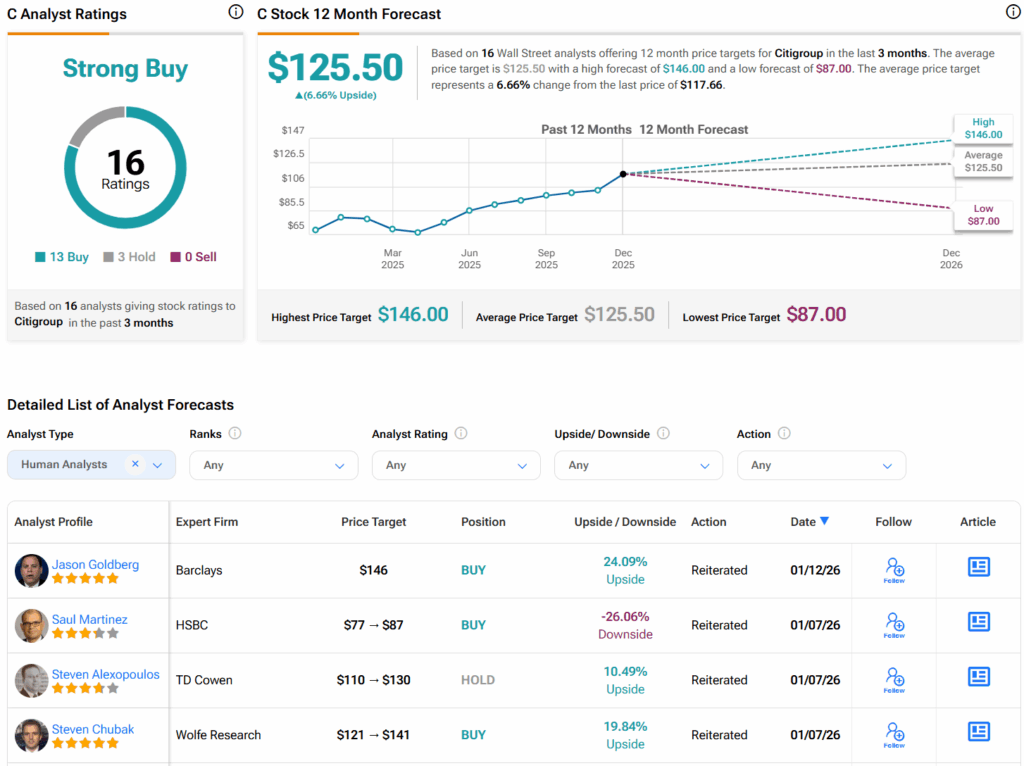

Turning to Wall Street, analysts have a Strong Buy consensus rating on Citigroup stock based on 13 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Citigroup price target of $125.50 per share implies 6.7% upside potential.