Banking giant Citigroup (C) continues to reduce its headcount through more layoffs even after delivering market-beating fourth-quarter results. According to Bloomberg, the company slashed more jobs this week, reflecting CEO Jane Fraser’s goal to cut down expenses and improve profitability.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Citi jumped to a profit of $1.34 per share in Q4 2024 from a loss of $1.16 in the prior-year quarter, thanks to the strength in trading and investment banking. Moreover, the bank announced a $20 billion buyback program.

Citi Is Focused on Improving Profitability

The Bloomberg report noted that managing directors in the wealth business and technology unit are exiting the bank. Additionally, sources revealed that the company is removing a team that compiles data and analysis on Citigroup’s customers.

These layoffs are a part of the company’s efforts to streamline its operations and improve profitability to compete better with rival banks. In January 2024, Citi announced its plan to cut 20,000 jobs over a two-year period. Investors have acknowledged the bank’s efforts to enhance its profitability, with the stock up 37% in 2024.

During the Q4 2024 earnings call, CFO Mark Mason disclosed the bank’s plan to reserve $600 million for severance payments in 2025, as it continues to rightsize its workforce and reduce expenses.

Is Citigroup Stock a Buy, Sell, or Hold?

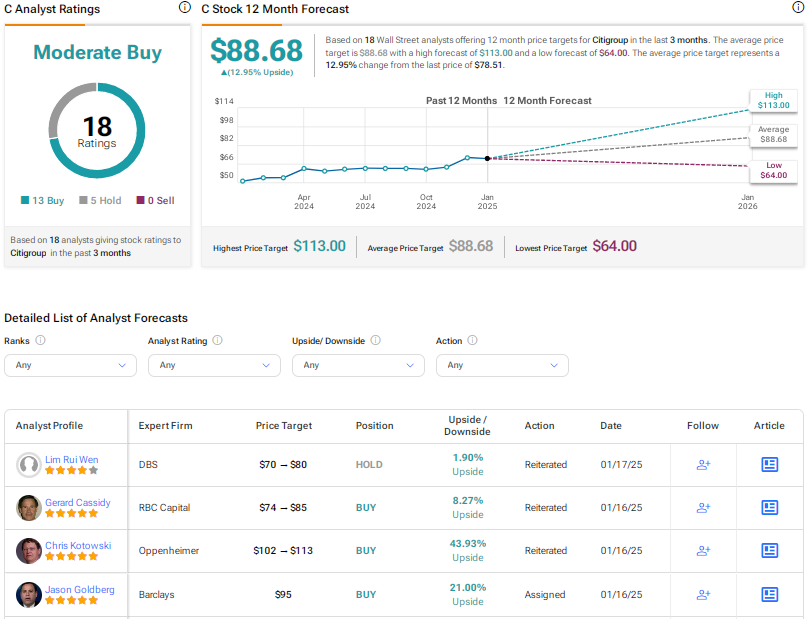

Wall Street is cautiously optimistic on Citigroup stock, with a Moderate Buy consensus rating based on 13 Buys and five Holds. The average C stock price target of $88.68 implies about 13% upside potential.