Networking giant Cisco (CSCO) is scheduled to announce its results for the first quarter of Fiscal 2026 after the market closes on Wednesday, November 12. CSCO stock has risen about 22% year-to-date, driven by optimism about demand for artificial intelligence (AI) infrastructure and the prospects for the company’s security business. According to TipRanks’ Options Activity Tool, options traders are expecting a 5.67% move in either direction in CSCO stock in reaction to Q1 FY26 results. Notably, this implied move is higher than CSCO stock’s average post-earnings move (in absolute terms) of 3.38% over the past four quarters.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

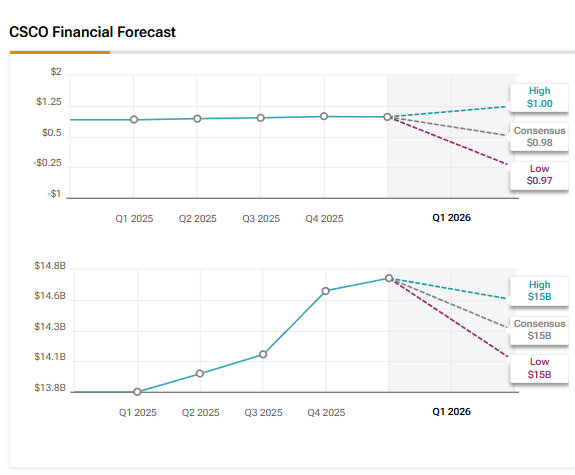

Meanwhile, Wall Street expects Cisco to report earnings per share (EPS) of $0.98, reflecting growth of about 8% from the prior-year quarter. Revenue is expected to grow nearly 7% year over year to $14.78 billion.

Analysts’ Views Ahead of Cisco’s Q1 Earnings

Heading into Q1 earnings, UBS analyst David Vogt upgraded Cisco stock to Buy from Hold and raised the price target to $88 from $74. The 5-star analyst cited a multi-year growth cycle driven by AI infrastructure demand, a large-scale Campus refresh cycle (including upgrades to AI-enabled smart switches), and strength in the security business from the Splunk acquisition. Vogt highlighted $2 billion in AI orders in Fiscal 2025 and growing enterprise and sovereign demand.

In fact, enterprise orders are nearing $1 billion, up sharply from a “couple hundred million” in the most recent quarter, positioning Cisco for continued AI-induced growth in Fiscal 2026 and Fiscal 2027, noted Vogt.

Meanwhile, Morgan Stanley analyst Meta Marshall reiterated a Buy rating on Cisco stock with a price target of $77. The 4-star analyst expects the company to exceed Q1 revenue expectations, but cautioned that Q2 FY26 guidance could be a “little soft” due to the federal government shutdown and elevated component costs, which were highlighted by rival Extreme Networks (EXTR) last month.

Consequently, Marshall doesn’t expect the Q1 earnings to be a major upside catalyst for CSCO stock, “barring a major upside surprise on AI orders.” The analyst noted that in Q4 FY25, Cisco’s AI orders surpassed $800 million. Commenting on concerns about an AI bubble, Marshall contended that data center spending remains strong, supporting his bullish stance on CSCO stock. “The stock is a low-multiple way to play the AI data center boom, as Cisco grows its business serving the so-called hyperscalers,” concluded Marshall.

AI Analyst Is Bullish on Cisco Stock Ahead of Q1 Print

Interestingly, TipRanks’ AI Analyst has assigned an Outperform rating to Cisco stock with a price target of $79, indicating about 9.6% upside potential. The AI analyst’s rating is based on Cisco’s solid financial performance and positive earnings call insights, highlighting strong growth in AI infrastructure and strategic innovation. Additionally, technical analysis supports a stable outlook, while valuation concerns are mitigated by a decent dividend yield.

Overall, TipRanks’ AI Analyst concluded that Cisco’s strategic focus on AI and innovation positions it well for growth in the years ahead, despite challenges in some segments.

Is Cisco Stock a Good Buy?

Currently, Wall Street has a Moderate Buy consensus rating on Cisco stock based on 10 Buys and five Holds. The average CSCO stock price target of $78.55 indicates 9% upside potential.