Shares of Circle Internet Group (CRCL) dropped 15.5% yesterday and are trending down an additional 3.7% in early hours trading this morning. The steep decline wiped out roughly $5 billion in market capitalization from the world’s second-largest stablecoin issuer. With shares having soared almost 750% from their $31 IPO price on June 5, investors are now asking whether Circle, the USDC stablecoin issuer, is running out of steam.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Breaking Down Circle’s Stock Performance

On June 17, the U.S. Senate passed the GENIUS Act, proposing to establish a regulatory framework for stablecoins. This event marked a significant milestone for the sector, pushing up prices of cryptocurrencies and related-companies. Since that day, CRCL stock has surged more than 76%. Additionally, Circle’s partnership with Fiserv (FI) and PayPal (PYPL) to enhance their stablecoins also contributed momentum to the stock.

Conversely, ace hedge fund manager Cathie Wood started dumping CRCL shares from her various ARK Invest ETFs in consecutive trading sessions, signaling caution regarding the stock’s future. With this in mind, let’s examine the factors that may be turning investors away from the stock.

Circle Stock Slips as Analysts’ Confidence Wavers

For a new kid on the block, Circle stock generated significant frenzy in its initial days. However, analysts have issued mixed recommendations on the stock, sending confusing signals to investors.

On June 22, Seaport Global Securities top analyst Jeff Cantwell initiated coverage on CRCL with a “Buy” rating and a price target of $235. Although Cantwell gave a bullish call, his price target implied a 2.2% downside potential from the previous trading day’s closing price of $240.28. The five-star analyst described Circle as a “top-tier crypto disruptor” and said the company is well-positioned for long-term success. His bullish view stemmed from the expectation that improving regulatory framework would drive greater adoption of stablecoins.

On the other hand, Compass Point analyst Ed Engel initiated coverage of Circle stock with a “Hold” rating and a $205 price target. This lower price target implied a significant downside potential of 22% from the closing price of $263.45 recorded on June 23. Engel believes that Circle stock’s valuation already reflects highly optimistic long-term assumptions, making it difficult to justify a higher valuation.

Moreover, yesterday, US Tiger Securities also started coverage of CRCL stock with a “Hold” rating with an even lower price target of $200. The firm believes that much of the bullish sentiment surrounding the regulatory framework and enhanced stablecoin adoption is already priced into the stock. The firm contends that despite Circle benefiting from being a regulated first-mover, the stock’s near-term valuation is rich.

Is Circle Stock a Buy?

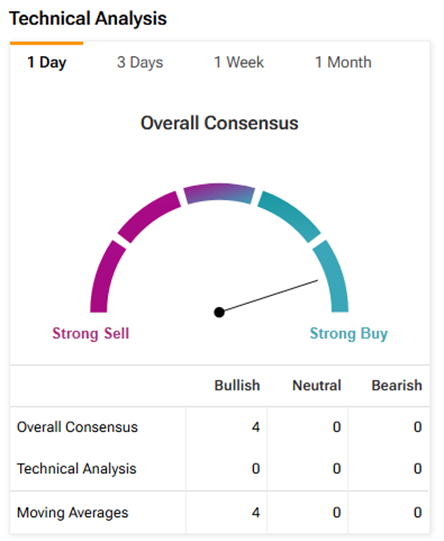

It is indeed too early to comment on Circle’s future stock trajectory. So far, only a few analysts have issued recommendations on the stock. However, TipRanks’ Technical Analysis Tool shows a Strong Buy consensus based on four Bullish indictors.