Circle Internet Group (CRCL) is set to release its third-quarter fiscal 2025 results before the markets open today, November 12. Wall Street expects Circle to report earnings of $0.22 per share on revenue of $706.70 million. This marks a sharp rebound from Q2, when Circle reported a net loss of $4.48 per share, well below analyst expectations. In that quarter, the company’s revenue surged 53% year-over-year to $658 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Circle Internet is best known as the largest issuer of the USDC stablecoin, a key player in the digital payments ecosystem. The company’s shares surged over 235% following its June 2025 IPO but have since cooled, declining 8.7% year-to-date as investor enthusiasm has leveled off. Circle’s strong brand reputation, regulatory tailwinds, and growing stablecoin adoption provide solid growth potential, but valuation pressures and competitive risks continue to weigh on sentiment.

Catalysts Impacting Q3 Results

Circle’s Q3 performance is expected to benefit from clearer regulatory frameworks and increasing global demand for stablecoins such as USDC. Stronger adoption across payment networks, growing institutional interest, and expansion of its network partnerships could provide additional revenue momentum.

Investors will look closely at key metrics including transaction volume, market share in the stablecoin sector, and updates on new product launches or strategic partnerships. Profitability trends will also be under scrutiny as Circle faces rising competition from Tether and emerging decentralized payment solutions.

What Analysts Are Saying About Circle

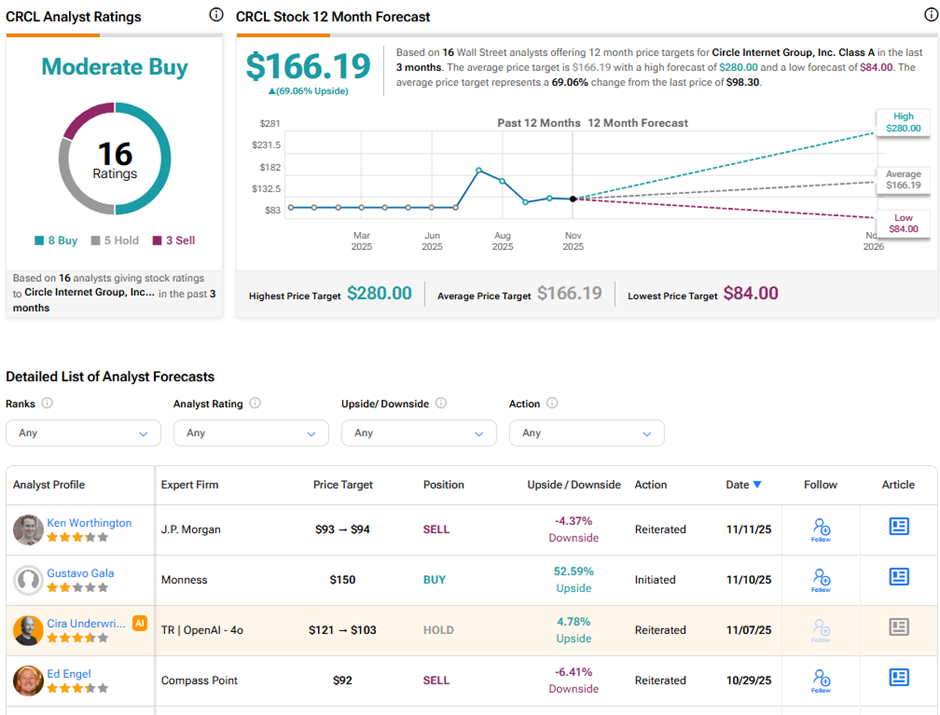

Ahead of the Q3 print, J.P. Morgan analyst Ken Worthington reiterated his “Sell” rating on CRCL stock, while raising the price target modestly from $93 to $94, implying 4.4% downside potential. Worthington believes Circle remains overvalued compared to its fundamentals and that investor optimism may have already priced in near-term growth.

In contrast, Monness Crespi Hardt analyst Gustavo Gala recently initiated coverage with a “Buy” rating and $150 price target, implying an impressive 52.6% upside potential. Gala believes that Circle is well positioned to gain a large share of the on-chain money supply because its stablecoin, USDC, helps strengthen the U.S. dollar’s dominance and makes global transactions more efficient. He pointed out that Circle’s valuation is lower than rival Tether’s, suggesting there is potential for price growth. He expects margin expansion and stronger dollar-denominated revenues in the near term.

Is CRCL a Good Stock to Buy?

Analysts remain divided on Circle’s long-term outlook. On TipRanks, CRCL stock has a Moderate Buy consensus rating based on eight Buys, five Holds, and three Sell ratings. The average Circle Internet price target of $166.19 implies 69.1% upside potential from current levels.