Cipher Mining’s stock (CIFR) surged 19% on Monday after the company announced a massive $5.5 billion, 15-year lease deal with Amazon Web Services (AWS) (AMZN). The agreement will see Cipher deliver 300 megawatts of high-performance computing (HPC) power by the end of 2026, the kind needed to train and run large AI models.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company said construction on the first phase will begin next July. The new facilities will feature a mix of air and liquid-cooled racks. It shows how Cipher is moving beyond crypto mining and into the fast-growing world of AI data centers.

Cipher Builds a Giant Data Hub in Texas

Alongside the AWS partnership, Cipher also revealed plans to take majority control of a new joint venture to develop a 1 gigawatt (GW) data center complex in West Texas. The project, named Colchis, will span 620 acres near an American Electric Power substation and has already secured a Direct Connect agreement with AEP. The facility is expected to be completed by 2028.

The deal highlights a growing trend among crypto miners who are now repurposing their energy-heavy operations to serve AI workloads. Tech giants like Amazon, Google (GOOGL), and Microsoft (MSFT) are hungry for more computing capacity, and this growing demand is giving Cipher a new lease on life beyond crypto mining.

Crypto Miners Are Turning to AI Infrastructure

Cipher’s move mirrors that of IREN (IREN) (formerly Iris Energy), which signed its own $9.7 billion cloud deal with Microsoft this week, sending its shares up more than 23%. Both companies have positioned themselves at the intersection of blockchain infrastructure and artificial intelligence, a space that’s becoming one of the most lucrative pivots in tech.

Cipher also disclosed $72 million in third-quarter revenue and $41 million in adjusted earnings. Including the AWS deal and a previous $3 billion hosting contract with Fluidstack and Google, the company now has a total of roughly $8.5 billion in AI hosting agreements.

“As the industry evolves rapidly and validates our thesis that Tier 1 hyperscalers would turn to Cipher and to non-traditional areas in Texas, we’re more confident than ever that Cipher is among the best-positioned companies in the world to seize additional opportunities created by the growing power shortfall,” said CEO Tyler Page.

Cipher’s pipeline now totals 3.2 gigawatts (GW) of site capacity, reinforcing its strategy of transforming from a crypto miner into a full-scale digital infrastructure provider.

Is Cipher Mining a Good Stock to Buy?

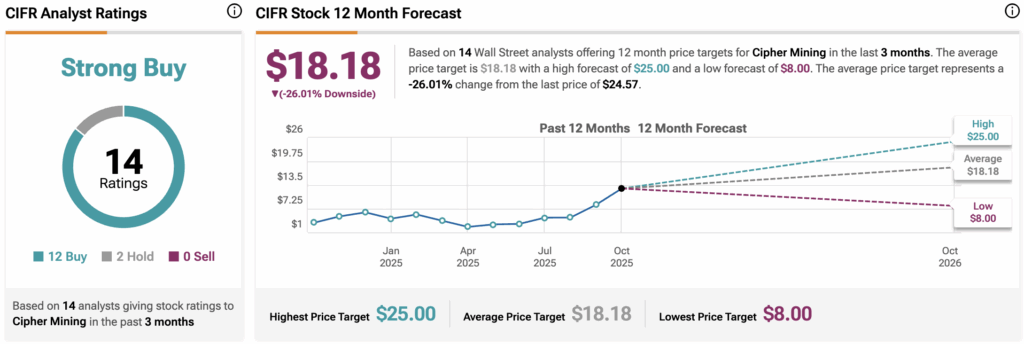

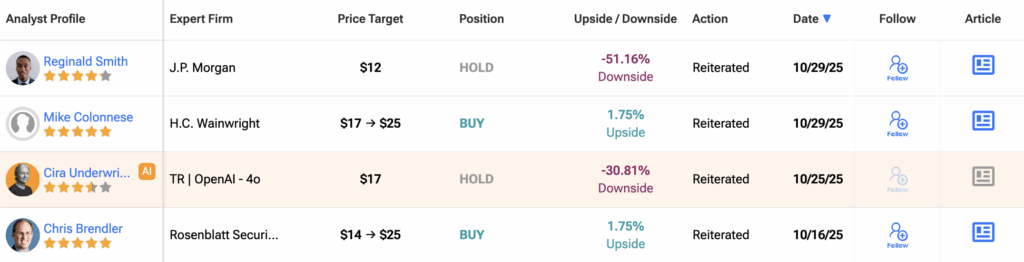

According to data from TipRanks, 14 Wall Street analysts have rated Cipher Mining stock a “Strong Buy.” Out of those, 12 recommend a Buy, while two suggest a Hold, and none advise a Sell.

The average 12-month CIFR price target stands at $18.18, implying a potential 26% downside from the current price.