Shares of Ciena (CIEN) declined in pre-market trading after the company reported disappointing Fiscal Q4 earnings. The networking systems company’s adjusted earnings declined by 28% year-over-year to $0.54 per share, below consensus estimates of $0.65 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, the company’s revenues fell by 0.5% year-over-year to $1.12 billion in the fourth quarter, which was above Street estimates of $1.1 billion. Additionally, two CIEN customers represented more than 10% of the company’s revenue in the Fiscal fourth quarter and in FY24, combining for a total of 31.2% and 25.1% of revenue, respectively.

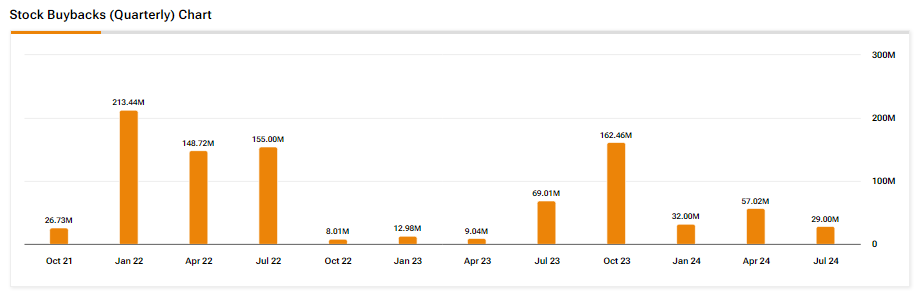

CIEN Repurchases Stock in Q4

In the Fiscal fourth quarter, CIEN repurchased around 2.1 million shares of common stock for an aggregate price of $132.0 million.

CIEN Announces Independent Chair of Board of Directors

Moreover, the company announced the appointment of Lawton W. Fitt the company’s Board Chair effective from December 11. Fitt will take charge as Patrick H. Nettles, Ph.D., has stepped down as Executive Chair following not to stand for re-election at the end of his term.

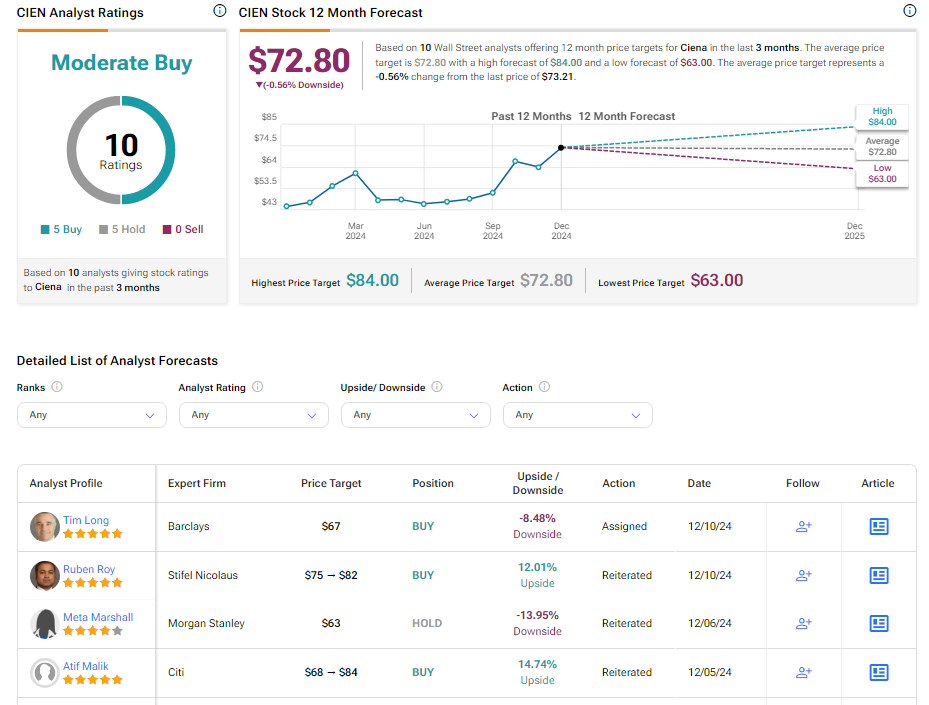

Is CIEN a Good Buy?

Analysts remain cautiously optimistic about CIEN stock, with a Moderate Buy consensus rating based on five Buys and five Holds. Over the past year, CIEN has increased by more than 60%, and the average CIEN price target of $72.80 implies a downside potential of 0.6% from current levels. These analyst ratings are likely to change following CIEN’s results today.