In this piece, I evaluated two pet-supply retailer stocks, Chewy (NYSE:CHWY) and Petco Health and Wellness (NASDAQ:WOOF), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a bullish view of one and a bearish view of the other.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sometimes considered the “Amazon of pet supplies,” Chewy is an online retailer of pet food, supplies, prescription products, and other pet-related items for a wide range of animals, from dogs and cats to horses, birds, and reptiles.

Petco Health and Wellness also offers pet-care products such as food, treats, and other supplies, both through its brick-and-mortar stores and online. The company also offers services like grooming.

Shares of Chewy are up 2% year-to-date but have plunged 36% over the last year, while Petco stock is flat year-to-date but has plummeted 65% over the last 12 months.

With nearly exact share-price performances year-to-date, it may be surprising that one of these retailers is profitable while the other has swung to a loss over the last year or so.

Below, we’ll compare their price-to-sales (P/S) ratios to gauge their valuations against each other and against that of their industry. The Specialty Retail industry is trading in line with its three-year average P/S of 0.77x. It’s also trading at a P/E of 26x, slightly higher than its three-year average P/E of 20x.

Chewy (NYSE:CHWY)

At a P/E of 125x, Chewy certainly isn’t cheap. However, its forward P/E of about 26x is far more reasonable, and its P/S of 0.97x is only slightly higher than the average of other specialty retailers. The sell-off over the last year appears to have presented a buy-the-dip opportunity, suggesting that a bullish view may be appropriate in light of the company’s recent profitability.

It can be risky to invest in a company based on forward multiples because there is no guarantee that a company will grow into its valuation. However, for an e-commerce business like Chewy, things appear to be heading in the right direction.

First, the company has put up some tremendous growth over the last year, swinging from a loss in the first quarter of 2023 to this year’s first quarter (although it was profitable in all of 2023, with $39.6 million in net income). Chewy reported earnings of 15 cents per share on $2.88 billion in revenue versus the consensus numbers of four cents per share on $2.85 billion in sales.

Importantly, Chewy’s gross margin expanded by 130 basis points year-over-year to 29.7%, while its net margin expanded by 150 basis points to 2.3%. Given that the company was unprofitable a year ago, these are critical metrics to continue to watch.

Notably, Amazon didn’t turn its first profit until the fourth quarter of 2001 — after being founded in 1994 — but today, it’s an e-commerce juggernaut. This isn’t to say Chewy will be anywhere near as profitable because it doesn’t have a web services platform like Amazon does, but it does suggest the company is heading in the right direction.

Unfortunately, Chewy has struggled to shake off comparisons with a certain online pet-supply retailer from 25 years ago. However, pet owners today are happily ordering things for their furry friends online. Not only have we had a pandemic that “trained” them to do so, but online shopping is simply far more prevalent today than 25 years ago.

What Is the Price Target for CHWY Stock?

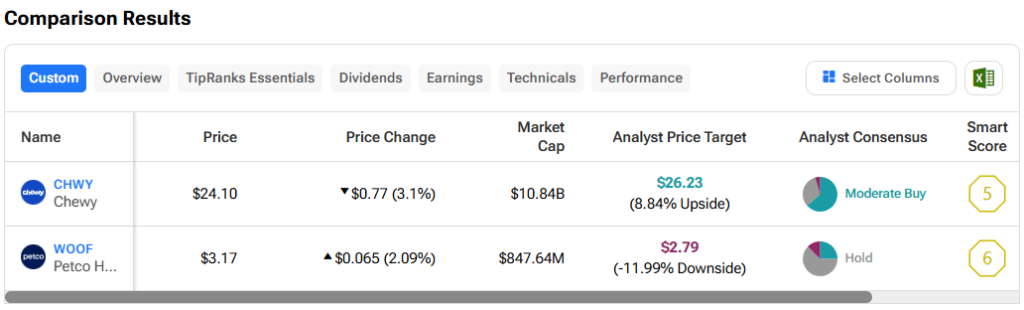

Chewy has a Moderate Buy consensus rating based on 14 Buys, seven Holds, and one Sell rating assigned over the last three months. At $26.23, the average Chewy stock price target implies upside potential of 8.8%.

Petco Health and Wellness (NASDAQ:WOOF)

At a P/S of 0.14x, Petco is trading at a deeply depressed valuation, especially considering that its forward P/S is the same — suggesting zero sales growth over the next year. However, unlike Chewy, the retailer doesn’t appear to be heading in the right direction, suggesting that a bearish view might be appropriate.

For the most recent quarter, Petco posted an adjusted loss of four cents per share on $1.51 billion in revenue versus expectations of six cents per share in losses on $1.53 billion in sales. While Chewy’s net sales ticked up 3% year-over-year, Petco’s sales slipped 1.7% year-over-year, including a 1.2% decline in comparable-store sales.

The retailer’s net losses amounted to $46.5 million or 17 cents per share versus net losses of $1.9 million or one cent per share in the year-ago quarter. Free cash flow was negative at -$41.1 million, down from -$24.4 million a year ago.

In all of 2023, the retailer’s net revenue rose 3.6% year-over-year to $6.3 billion, but that includes an extra week of sales versus 2022. The company also posted a net loss of $1.3 billion or $4.78 per share for the entire year. Full-year free cash flow tumbled to -$9.9 million from $68 million in 2022.

While Petco may not be heading for the dustbin, these numbers are not indicative of an improving financial situation, suggesting that caution may be warranted.

What Is the Price Target for WOOF Stock?

Petco Health and Wellness has a Hold consensus rating based on two Buys, five Holds, and one Sell rating assigned over the last three months. At $2.79, the average Petco stock price target implies downside potential of 11.99%.

Conclusion: Bullish on CHWY, Bearish on WOOF

It’s no secret that inflation has been pressuring consumer wallets and retailers alike, but Chewy’s growth and Petco’s slump suggest this issue could be affecting Petco more than Chewy. Given that the company also operates brick-and-mortar stores, it’s at an automatic disadvantage to Chewy because its expenses are far higher.

Additionally, Autoship sales accounted for 77.6% of Chewy’s sales in the latest quarter, up slightly from 75.2%. Price-conscious customers are clearly opting to save 5% on everything by using Autoship. Add in stellar customer service at Chewy (you get a real person when you call in), and Chewy has the makings of an excellent company with long-term success. Finally, the recent dip in its share price over the last year makes this stock affordable.