Chewy (CHWY) shares dropped sharply over 6% in premarket trading on Wednesday after the online pet retailer posted first-quarter earnings that fell short of analyst expectations. The company reported GAAP net income of $62.4 million, or $0.15 per share, missing the $68.9 million or $0.16 per share forecast from analysts surveyed by Visible Alpha. On an adjusted basis, Chewy delivered earnings of $0.35 per share, which was just a notch above the $0.34 analysts had expected.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Overall, Chewy faced elevated expectations after a recent breakout and a strong 37% rally year-to-date.

Chewy Ramps Up Customer Growth

Following two years of decline, Chewy has added active customers for the second consecutive quarter. Total active customers increased 3.8% to 20.76 million, up from 1.7% growth in fiscal Q4, surpassing analyst expectations of 20.67 million. Overall sales rose 8% year-over-year to $3.12 billion, surpassing analyst expectations of $3.08 billion.

Praising the numbers, CEO Sumit Singh stated that these results highlight the resilience of the pet market and reinforce Chewy’s compelling value proposition and ongoing ability to capture market share.

Chewy Sticks to Full-Year Guidance

The company emphasized that fiscal year 2025 is beginning on a strong note. The company reiterated its full-year sales growth forecast of 6% to 7%, projecting revenue between $12.30 billion and $12.45 billion.

For Q2, Chewy anticipates adjusted EPS in the range of $0.30 to $0.35 and sales between $3.06 billion and $3.09 billion, slightly above analyst expectations of $0.31 EPS and $3.04 billion in revenue.

Is CHWY a Good Stock to Buy?

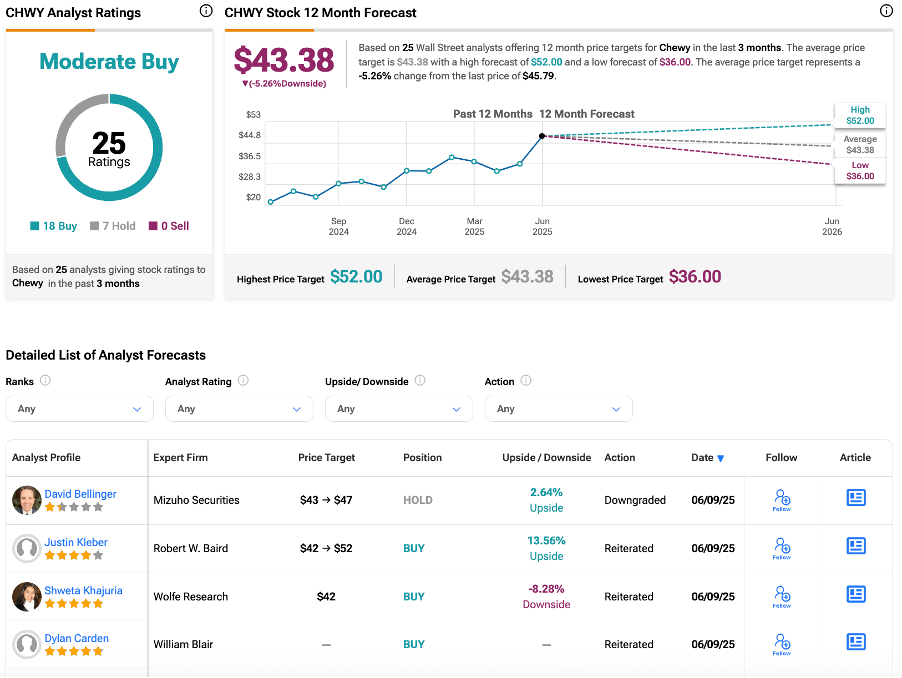

According to TipRanks, Wall Street has a Moderate Buy consensus rating on CHWY stock, based on 18 Buys and seven Holds assigned in the last three months. The average Chewy stock price target of $43.38 implies a downside of over 5%.