The stock of Chipotle Mexican Grill (CMG) is down 4% after the restaurant chain reported mixed financial results that disappointed investors. At one point, CMG stock was down 7% in after-hours trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company, known for its burritos and tacos, posted earnings per share (EPS) of $0.27, which beat consensus forecasts that called for earnings of $0.25. However, revenue of $2.79 billion fell short of expectations for sales of $2.82 billion in the quarter. Sales rose 13% from a year ago.

Same-store sales gained 6% during the July through September quarter, just short of the 6.3% expected on Wall Street. Foot traffic in Chipotle’s restaurants increased by 3.3%. Digital or online sales accounted for 34% of the company’s food and beverage sales in Q3. Chipotle opened 86 new restaurants during the quarter, 73 of which include a “Chipotlane” for online order pick-ups.

Higher Costs at Chipotle

Management blamed the mixed results on higher costs for the company’s food, ingredients, and beverages. Those costs rose during the quarter as the company increased its portion sizes following a social media backlash over the amount of food it gives to patrons.

Looking ahead, Chipotle reiterated its forward guidance that calls for same-store sales to grow by a mid- to high-single-digit percentage in the current fourth quarter of the year. The company also forecast that it will open between 285 and 315 new restaurants in 2024 and as many as 345 new locations in 2025.

This is the first quarterly results from Chipotle Mexican Grill since CEO Brian Niccol departed to lead Starbucks (SBUX). Chipotle’s chief operating officer (COO), Scott Boatwright, is the company’s interim CEO. CMG stock has increased 32% so far this year.

Is CMG Stock a Buy?

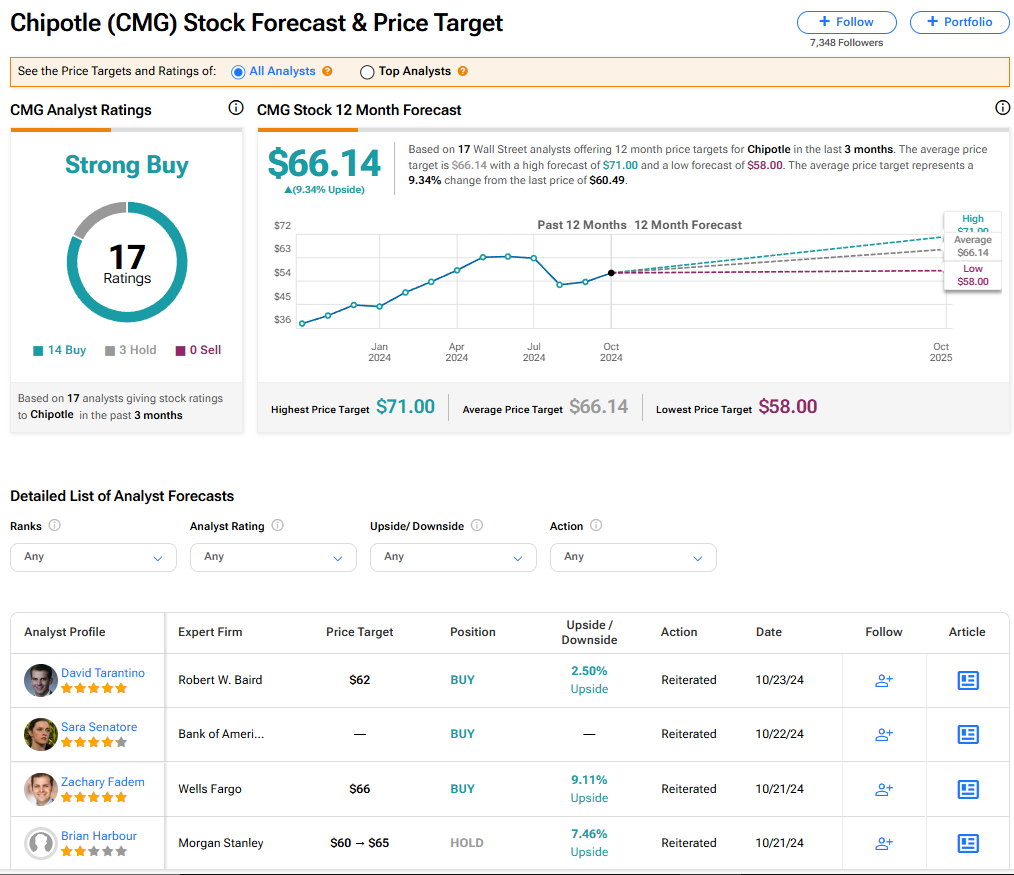

The stock of Chipotle Mexican Grill has a consensus Strong Buy rating among 17 Wall Street analysts. That rating is based on 14 Buy and three Hold recommendations issued in the last three months. There are no Sell ratings on the stock. The average CMG price target of $66.14 implies 9.34% upside from current levels.