Chipotle (NYSE:CMG) CFO Jack Hartung has decided to retire after nearly 25 years with the restaurant giant. The announcement comes just days after Chipotle’s significant 50-for-1 stock split and ahead of the company’s second-quarter results.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Hartung’s Departure as CFO

Hartung has served as CMG’s CFO since 2002. His retirement will be effective from March 31, 2025. Stepping into Hartung’s role is Adam Rymer, another Chipotle veteran who has been with CMG since 2009 and currently holds the position of Vice President of Finance.

Slide in CMG Stock

Notably, Hartung’s departure comes only days after the burrito chain executed a historic 50-for-1 stock split. While Chipotle’s strong financial performance and international expansion are key positives, the company’s share price has dropped by nearly 9% over the past month amid concerns over frothy valuation and weak consumer sentiment. Its price-to-earnings multiple currently stands at a whopping 67x.

CMG’s Q2 in Focus

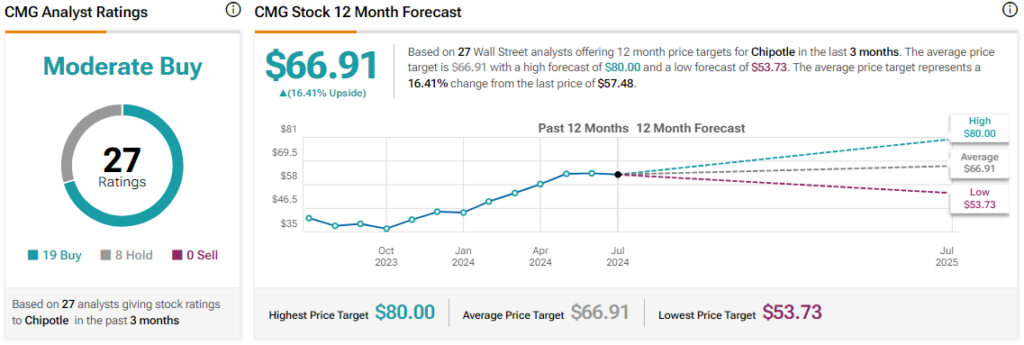

Analysts, however, remain upbeat about Chipotle’s prospects. Truist’s Jake Bartlett recently reiterated a Buy rating on the stock while raising his price target to $74 from $70.4. Stifel Nicolaus’ Chris O’Cull also maintains a Buy rating on Chipotle with a $70 price target. The analyst anticipates another strong performance from the company on July 24, when it is scheduled to report its second-quarter results. The Street expects Chipotle to post an EPS of $0.31 on revenue of $2.93 billion for the quarter.

Is CMG Stock a Buy, Sell, or Hold?

Overall, the Street has a Moderate Buy consensus rating on Chipotle and the average CMG price target of $66.91 implies a 16.4% potential upside in the stock. That’s on top of a nearly 78% jump in the company’s share price over the past three years.

Read full Disclosure