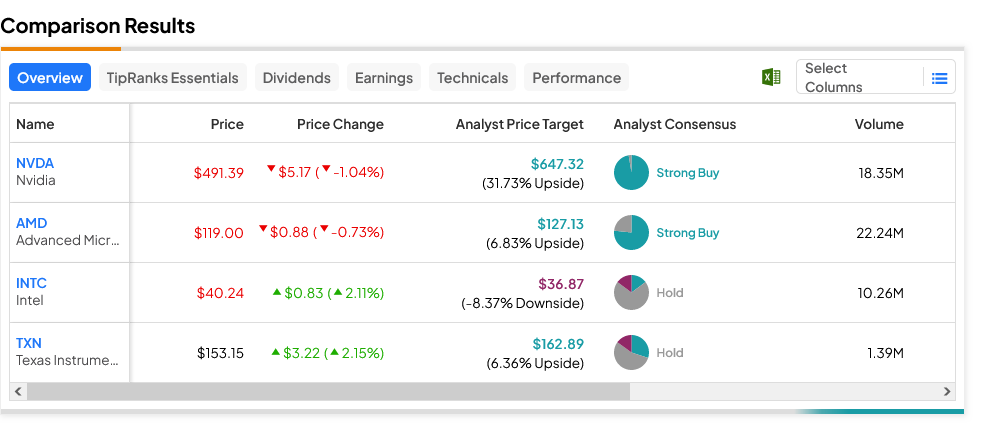

Is the party nearly over for chip stocks? The chip sector has been a winner of late, thanks to the growing momentum around artificial intelligence. But a look at what Michael Burry of “The Big Short” fame has been up to lately is making some question whether or not the chip stock surge has legs. Chip stocks themselves are mixed this morning, with both Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) down—just over 1% and fractionally, respectively—and Intel (NASDAQ:INTC) and Texas Instruments (NASDAQ:TXN) up just over 2% each in Wednesday morning’s trading session.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Burry took aim at the chip sector by buying 100,000 put options on the iShares Semiconductor ETF (NASDAQ:SOXX), reports noted, which contains shares of Nvidia, AMD, and Broadcom (NASDAQ:AVG), all of which saw significant enthusiasm in the markets thanks to the growing AI rush. The iShares ETF itself is up 48% this year alone and is on track to improve still further with today’s trading day. Thus, Burry’s bet is seen as somewhat contrarian.

Earlier Contrarian Bets Didn’t Go According to Plan

However, this isn’t Burry’s first contrarian bet. Just back in August—and famously, too—Burry put a massive short on the market itself, with two million puts on the SPDR S&P (NYSEARCA:SPY) and another two million on Invesco QQQ (NASDAQ:QQQ). Yet, a recently posted 13F filing notes that Burry’s fund, Scion Asset Management, no longer possesses said put options. And just to round things out, Burry also revealed that he’s put a major bet on the Chinese e-retail market, buying in on Alibaba (NYSE:BABA) and JD.com (NASDAQ:JD) with 50,000 shares and 125,000 shares, respectively.

Which Chip Stocks are Good Buys Right Now?

Turning to Wall Street, INTC stock is the clear laggard here. With an average price target of $36.87 per share, this Hold-rated stock offers 8.37% downside risk. On the other hand, NVDA stock remains the clear winner, as this Strong Buy offers 31.73% upside potential on its $647.32 average price target.