Chinese AI companies are circumventing U.S. export controls by physically shipping massive volumes of training data out of China and into countries such as Malaysia. According to reports from NBC News, engineers recently carried over 4.8 petabytes of data stored across 60 hard drives by hand through airports to Malaysian data centers. Once there, the data was processed using hundreds of Nvidia (NVDA) AI servers rented locally.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Regulations’ Achilles’ Heel

This workaround highlights the growing challenge U.S. regulators face in enforcing chip restrictions. While Washington has blocked the sale of Nvidia’s high-end chips, such as the H100, to Chinese buyers, it has fewer controls on data movement and cloud computing use. Chinese firms are exploiting these loopholes to access powerful computing overseas, legally renting infrastructure in Southeast Asia to continue training large-scale AI models.

The suitcase strategy is just one part of a broader effort. Some Chinese AI developers are also using cloud services from global providers like Amazon (AMZN) and Microsoft (MSFT), which are not yet restricted. Others are working with international brokers to set up offshore compute hubs in Australia, the UAE, and Singapore, further blurring the lines of enforcement.

For U.S. companies, the picture is mixed. Nvidia continues to experience strong demand for its chips globally, despite restrictions on direct sales to China. However, these reports raise the risk of tighter future regulations that could target cloud services or indirect sales. That could limit the growth of Nvidia’s data center segment, which accounted for $39 billion out of its $44 billion in Q2 revenue.

What’s Next

The impact may not be limited to Nvidia. If Chinese firms succeed in maintaining their AI development pace through these circumvention strategies, U.S. tech companies face renewed competitive pressure. China’s DeepSeek model, for instance, was reportedly (though not verified) trained on smuggled chips and has achieved performance close to OpenAI’s GPT-4.

Malaysia, now a hotspot for this activity, is facing scrutiny from U.S. officials. The Malaysian government says it is tightening rules around its data center industry. Still, enforcement remains complex.

In conclusion, Global enforcement gaps are hindering the development of AI. While U.S. restrictions slow China’s access to high-end chips, they haven’t stopped it. For NVDA and its peers, that means continued demand, but also growing uncertainty.

Is NVDA Stock a Buy?

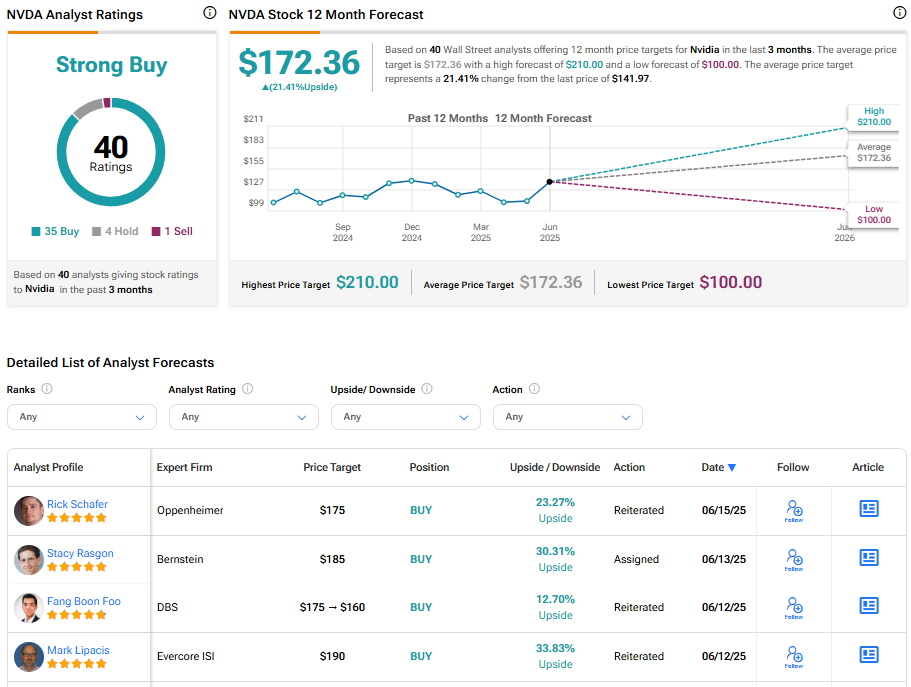

Turning to the Street’s analysts, Nvidia boasts a Strong Buy based on 40 recent ratings issued. The average NVDA stock price target is $172.36, implying a 21.41% upside.