Shares of Zeekr will begin trading on the New York Stock Exchange (NYSE) on Friday after the EV maker priced its initial public offering (IPO) at the top end of its price range. The company will trade under the symbol “ZK.” This IPO would mark the first major listing in the U.S. by a Chinese company since 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Details of Zeekr’s IPO

According to a Reuters report, Zeekr sold 21 million American depositary shares (ADSs) at $21 each and raised $441 million. The report stated that the company had earlier planned a sale of 17.5 million ADSs at a price between $18 and $21 per ADS.

Interestingly, Zeekr is backed by the Chinese-based automotive group Geely and offers many luxury vehicles, including a new upscale sedan. Geely will hold over 50% voting power in the company post the IPO.

Furthermore, Zeekr’s IPO gives it a fully diluted valuation, which includes securities such as options and restricted stock units, of $5.5 billion, at the higher end of its targeted range but below the $13 billion valuation it had at a prior funding round.

Is IPO ETF a Good Investment?

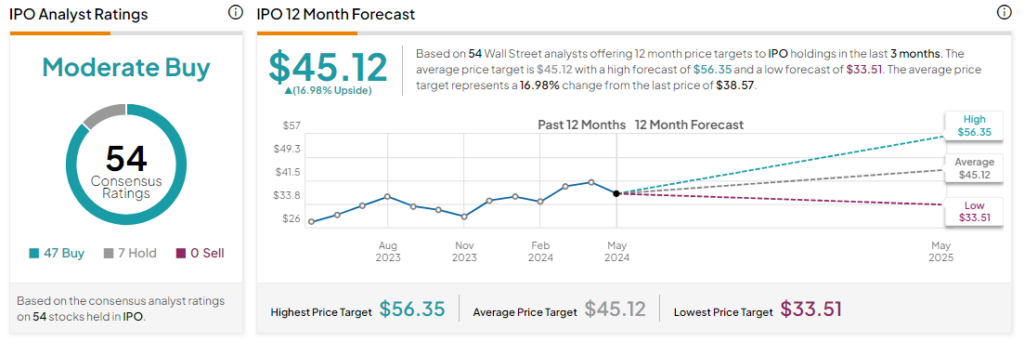

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Renaissance IPO ETF (NYSEARCA:IPO) shares based on 47 Buys and 7 Holds assigned in the past three months, as indicated by the graphic below. After a more than 30% rally in its share price over the past year, the average IPO price target of $45.12 implies around 17% upside potential from current levels.