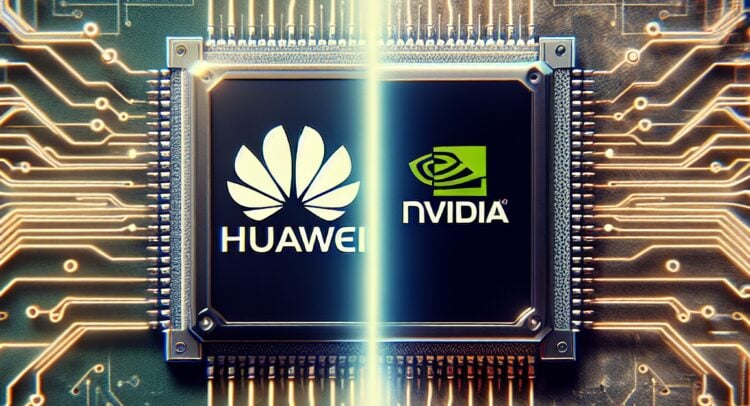

ByteDance plans to purchase about $5.6 billion in Huawei chips in 2026 after U.S. export rules blocked access to Nvidia (NVDA) processors. The deal marks a major change in the TikTok parent’s chip supply plan. It follows months of shortages that began when Washington limited shipments of Nvidia’s H20 chips to China in April.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The order will cover Huawei’s Ascend AI processors, which are now the top local option for Chinese tech firms. ByteDance bought almost no domestic chips in 2025, but reports indicate deliveries from Huawei will start soon. The new plan is part of China’s broader shift toward building self-reliant chip supply chains as access to American technology becomes harder to secure.

Rising AI Demand Drives the Deal

ByteDance’s AI tools are using more computing power each month. Its chatbot app Doubao now handles more than 30 trillion tokens daily, more than twice its volume in March. At the same time, Volcano Engine, the company’s cloud unit, reached about 49% of China’s public AI cloud market in the first half of 2025, beating Alibaba Group (BABA) and Baidu (BIDU) combined.

As a result, ByteDance needs a steady chip supply to run its growing AI network. Huawei’s Ascend 910C chip performs at about 60% of Nvidia’s H100, but it is produced in China and is not affected by trade limits. Huawei plans to make roughly 600,000 of these chips next year, twice as many as this year.

China’s Push for Chip Independence

The shift also matches new government rules that require more than half of chips in state-funded data centers to come from Chinese firms. Analysts expect domestic chips to make up about 50% of the country’s AI chip market in 2026. That change could help Huawei strengthen its lead and reduce China’s need for U.S. hardware.

Overall, the deal shows how export limits on Nvidia are reshaping China’s AI market, creating new winners at home while forcing global suppliers to step back.

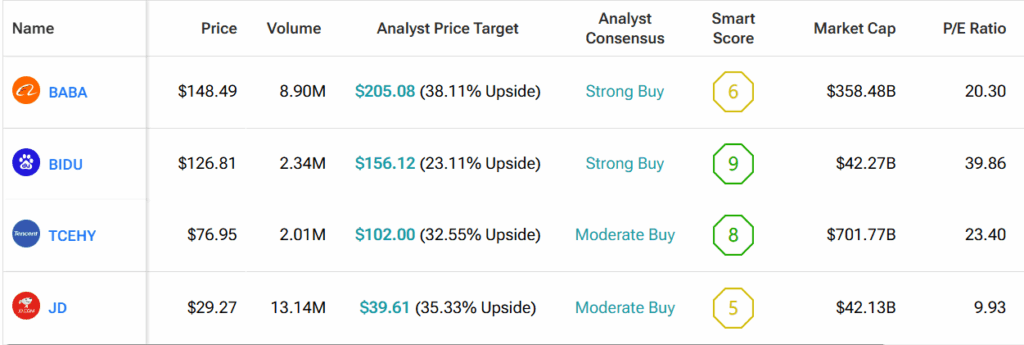

By using TipRanks’ Comparison Tool, we’ve assembled notable Chinese stocks traded on Wall Street. This tool helps investors gain an in-depth look at each ticker and the broader Chinese chip cloud and AI services.