Mainland China’s leading stock index has declined 7% as a rally that began in late September stalls.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The CSI 300 index closed 7.05% lower on October 9, ending a 10-day winning streak and bringing an end to a rally that had seen the stock exchange rise more than 25% since mid-September. The selloff in mainland China coincides with a downturn in Hong Kong’s Hang Seng index, which has declined more than 10% in recent days.

The reversal in Chinese equities comes after the government in Beijing failed to provide any new stimulus measures for the nation’s slumping economy. Chinese stocks rallied a month ago after the government unveiled stimulus measures that included mortgage rate cuts to support the property sector and capital to help companies’ buyback their own stock.

A Quick Exodus

Foreign investors had rushed into China in recent weeks, pushing the country’s stock exchanges to their highest levels since 2020. But the failure of Beijing to provide additional stimulus for the economy has disappointed investors and led to a quick exodus from Chinese markets.

China’s economy is struggling with weak consumer spending and a debt crisis in the property sector. The government has forecast 5% growth for the economy this year, which is slow by historic standards for the nation of 1.4 billion people. Some analysts say they still expect China’s government to announce more stimulus measures in coming months, but the timing is uncertain.

Is the iShares MSCI Hong Kong ETF a Buy?

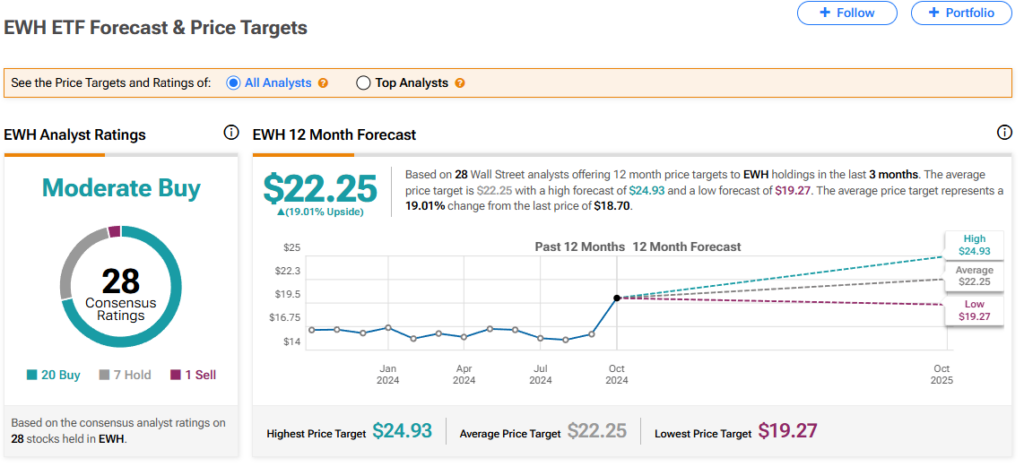

The iShares MSCI Hong Kong ETF (EWH), which tracks the investment results of equities listed in Hong Kong, has a consensus Moderate Buy rating among 28 Wall Street analysts. That rating is based on 20 Buy, seven Hold, and one Sell recommendations made in the past three months. The average EWH price target of $22.25 implies 19.01% upside potential from current levels.