Geely (GELYF) is expanding into Latin America in a deal with Renault (RNLSY) as the Chinese auto industry seeks friendly markets in which to operate amid concerns over U.S. and European tariffs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Renault and Geely plan to jointly manufacturer low-emission and electric vehicles (EVs) in Brazil as the French and Chinese automakers deepen an existing partnership. Under the deal, Geely will invest in Renault’s Brazilian business to become a minority shareholder in return for access to localized production, sales and services resources

Renault and Geely Strengthen Ties

It means Renault’s existing production facilities at the Ayrton Senna Complex in São José dos Pinhais would be made available for production of Geely vehicles. The deal will also see Renault distribute Geely’s portfolio of zero- and low-emission vehicles in Brazil.

The two companies launched a joint venture in Korea and worked together on powertrain technology.

“Together, we have built trust and an effective working relationship. These are great assets that we want to leverage today with this new cooperation in Brazil,” said Renault CEO Luca de Meo.

Geely Follows BYD into Brazil

Fellow Chinese EV maker BYD (BYDDF) recently launched a bid for cornering the Brazilian market with a new factory that was due to be operational in March this year.

However, in December Brazilian authorities halted construction of the Bahia site, saying workers were subjected to conditions comparable to slavery. BYD said it had cut ties with the contractor involved. The factory was set to BYD’s first EV plant outside of Asia, building on its Brazilian electric bus chassis manufacturing plant opened in Sao Paulo in 2015.

China’s EV makers are keen to diversify their footprints amid trade fears. In October the European Union hit Geely with an additional tariff of 18.8%, while BYD was slapped with 17% in additional taxes. This came after the US government in September of last year quadrupled the tariff rate on Chinese electric vehicles to 100%. Subsequently Donald Trump has further raised tariffs on a range of Chinese goods and threatened further levies.

Is GELYF a Good Stock to Buy?

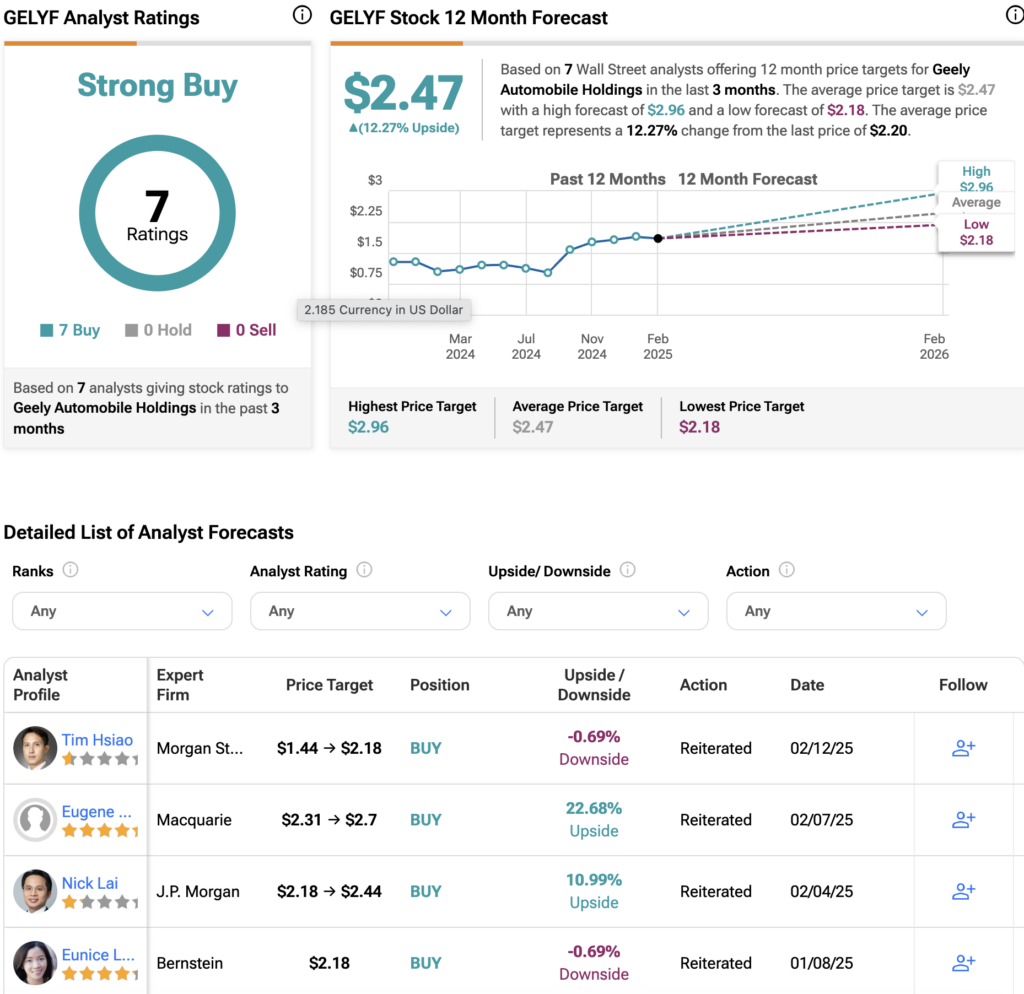

Overall, Wall Street has a Strong Buy consensus rating on GELYF stock, based on seven Buys among analysts offering 12-month price targets within the last three months. The average GELYF price target of $2.47 implies over 12% upside from current levels.