China accelerated its ambitions to become more self-sufficient in semiconductor manufacturing today with new rules for its domestic chipmakers.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

50% Domestic Rule

According to a Reuters report, Beijing is mandating that Chinese chipmakers use at least 50% domestically made equipment for adding new capacity.

It is understood that chipmakers seeking approval from the government to build or expand their plants have been told by authorities in recent months that they must prove through procurement tenders that at least half their equipment will be Chinese-made.

The requirements are relaxed for advanced chip production lines, where domestically developed equipment is not yet fully available.

It is all part of President Xi’s aims to develop a self-sufficient domestic semiconductor supply chain to wean itself off foreign, primarily U.S., technology.

This has followed the tariff trade spat with the U.S., technology export restrictions including chips from semiconductor giant Nvidia (NVDA), and the race to be the global leader in AI.

This is on top of continuing geopolitical tensions between the two countries over issues such as Taiwan and to a lesser extent Ukraine.

Self-Reliance Making Progress

The push for semiconductor independence is already making some headway with leading Chinese manufacturers already reportedly choosing domestic suppliers even in areas where foreign equipment from the U.S., Japan, South Korea and Europe remain available.

A former employee at local equipment maker Naura Technology, referring to the Semiconductor Manufacturing International Corporation, said: “Before, domestic fabs like SMIC would prefer U.S. equipment and would not really give Chinese firms a chance. But that changed starting with the 2023 U.S export restrictions, when Chinese fabs had no choice but to work with domestic suppliers.”

“Authorities prefer if it is much higher than 50%,” one source told Reuters. “Eventually they are aiming for the plants to use 100% domestic equipment.”

To support the local chip supply chain, Beijing has also poured hundreds of billions of yuan into its semiconductor sector through the “Big Fund”, which established a third phase in 2024 with 344 billion yuan ($49 billion) in capital.

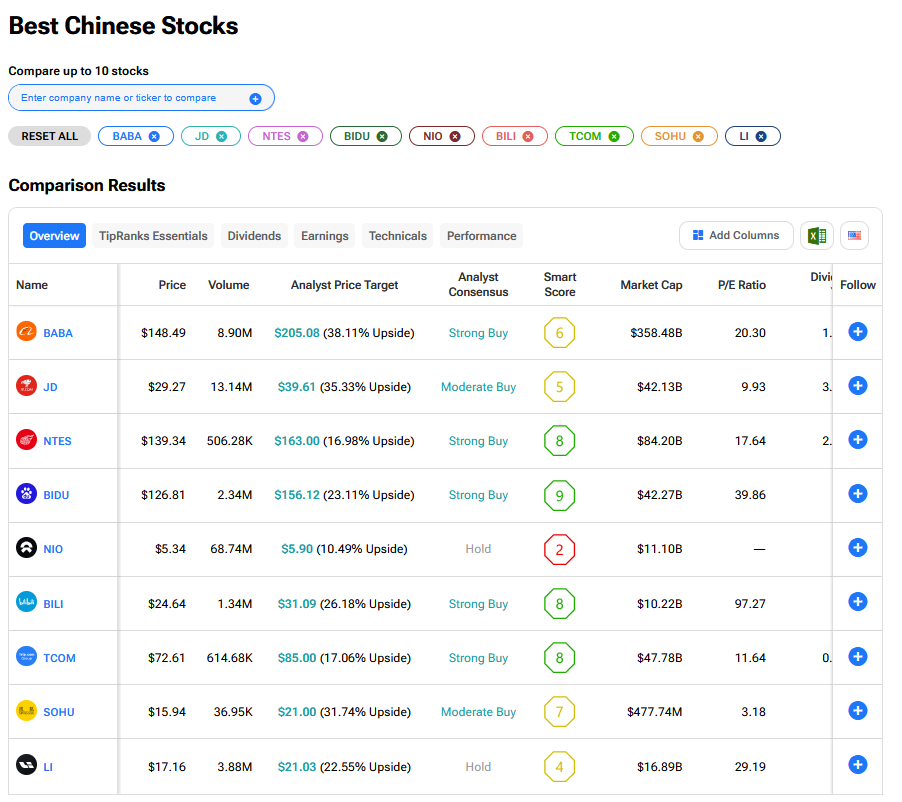

What are the Best Chinese Stocks to Buy Now?

We have rounded up the best Chinese stocks to buy now using our TipRanks comparison tool.