American semiconductor giant Nvidia’s (NVDA) CEO Jensen Huang has reassured U.S. policymakers that China’s military is unlikely to rely on American artificial intelligence (AI) chips, citing the risk of sudden export restrictions. In a recent interview with CNN, Huang stated that the White House “does not need to worry” about Nvidia’s technology being used to enhance Chinese military capabilities, as access to these advanced chips can be restricted at any time.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The White House has imposed strict export controls on advanced AI chips and semiconductor technologies, citing national security concerns. These restrictions have significantly affected American semiconductor companies, resulting in billions of dollars in lost revenue. For instance, Nvidia had to write off $5.5 billion in excess inventory due to the latest export curbs on its H20 chips.

Huang Is Set to Meet Chinese Officials

Huang is scheduled to hold a media briefing in Beijing on July 16 and meet with top Chinese officials. Ahead of his trip, he met with U.S. President Donald Trump and U.S. leaders to discuss the agenda. Following this, a bipartisan pair of U.S. senators sent a warning letter to Huang, asking him to be cautious during his upcoming trip to the mainland.

Importantly, they urged him not to meet with any companies believed to be working with the Chinese military or intelligence agencies. The Senators also asked Huang to abstain from meeting with companies listed on the U.S. export blacklist.

U.S. Chips Must be Available in All Markets

Nvidia finds itself at the center of the ongoing U.S.-China competition for AI dominance. Notably, many in the semiconductor industry argue that for American technology to set the “global standard,” it must be available in all major markets, including China, which boasts the world’s largest pool of AI developers.

Huang echoed this sentiment in the interview, stating, “We want the American tech stack to be the global standard… in order for us to do that, we have to be in search of all the AI developers in the world.”

The CEO has previously warned that limiting access to American chips does not undermine China’s AI ambitions. Instead, it is pushing domestic Chinese firms to innovate and develop competing technology. China’s Huawei has emerged as a formidable rival to Nvidia in the AI chip space.

Nvidia Continues to Leverage its AI Expertise

Nvidia has developed a new export-compliant AI chip for China. These chips are currently being tested by select Chinese firms, with plans to start exports in September, pending regulatory approval. Despite regulatory challenges, Nvidia continues to achieve significant milestones.

Last week, Nvidia’s stock surged over 4%, making NVDA the first U.S. company to reach $4 trillion in market capitalization. It is evident that Nvidia plays a central role in enhancing U.S.’ AI capabilities, but to maintain its leading position, it must be allowed to sell to China’s large semiconductor market.

Is NVDA Stock a Buy?

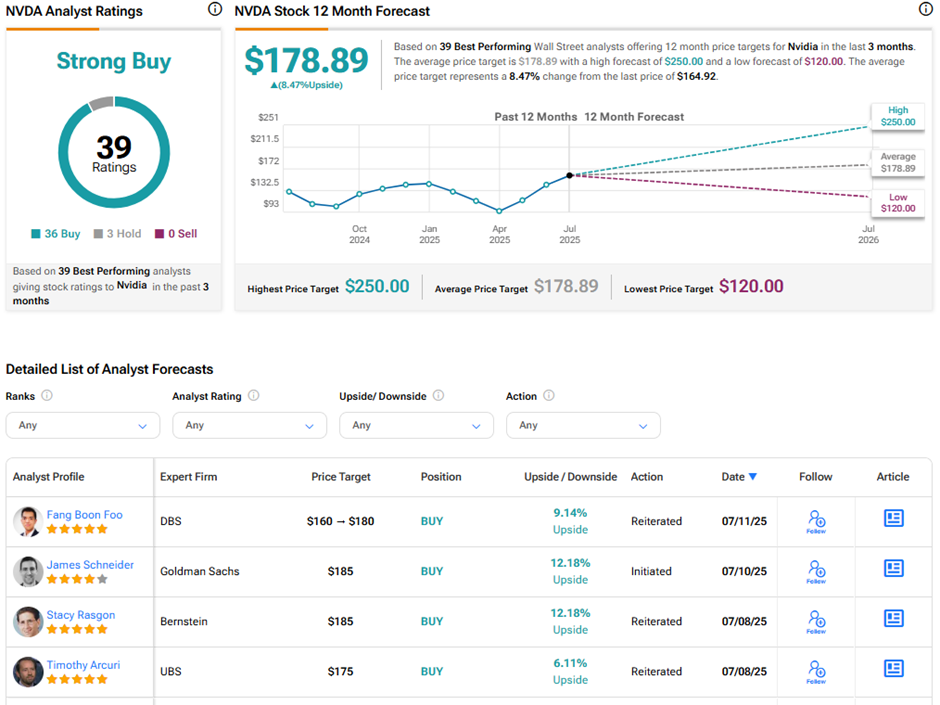

On TipRanks, NVDA stock commands a Strong Buy consensus rating based on 36 Buys and three Hold ratings. Also, the average Nvidia price target of $178.89 implies 8.5% upside potential from current levels. Year-to-date, NVDA stock has gained 22.8%.