On April 30, Nvidia (NVDA) CEO Jensen Huang sent a jolt through Washington with a blunt assessment: “China is not behind.”

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Speaking at the Hill & Valley Forum on Capitol Hill, Huang warned lawmakers that the U.S. and China are now “very, very close” in artificial intelligence, effectively claiming that the competition between the nations is neck and neck, not a situation where the U.S. is comfortably ahead. It wasn’t just a cautionary note; it was a wake-up call. Let’s explore how Huang’s claims affect the American AI stocks and how the U.S. might adjust to this new climate.

And now, the proof is here.

Huawei’s Surprise Counterattack

Just days after Huang’s remarks, Huawei began quietly shipping its new Ascend 910C AI chip – a processor designed to challenge Nvidia’s high-end H100, which powers everything from ChatGPT to cutting-edge robotics. The alarming fact is that Huawei built this chip without help from U.S. allies like TSMC (TSM) or ASML (ASML).

Instead, Chinese chipmaker SMIC used older lithography tools and clever engineering techniques – specifically Self-Aligned Quadruple Patterning (SAQP) – to simulate cutting-edge chipmaking. The result is a homegrown chip with double the computing power of its predecessor, rolling out just as Nvidia is forced to retreat from the Chinese market due to U.S. export bans.

The New AI Battlefield

Huawei’s timing is no accident. The U.S. government recently barred Nvidia from selling advanced AI chips like the H100, B200, and H20 to China, cutting off a key market. In response, Nvidia is moving manufacturing to the U.S., building new fabs in Arizona and Texas, and backing the $500 billion Stargate Project to future-proof American AI infrastructure.

However, after pulling back from China, Nvidia left a vacuum, and Huawei stepped in fast.

Why It Matters to Investors

The market isn’t sleeping on this. After Chinese firm DeepSeek unveiled a faster and cheaper ChatGPT rival, U.S. tech stocks plunged. Nvidia lost over $100 billion in market value in a single session.

If China can build good-enough AI chips and models more affordably, U.S. tech giants – from Meta (META) and Google (GOOG) to AMD (AMD) and ASML – face a new threat: margin compression and global competition.

Huang’s Message: Innovate, Don’t Isolate

Huang’s warning wasn’t just about competition but also about U.S. policy. He urged lawmakers to shift from restriction to reinvention, invest in R&D and AI workforce training, reconsider export controls that push China to build its own chip ecosystem, and embrace open innovation rather than retreat behind walls.

Yes, Stargate is massive. But Huang hints it may only keep pace, not restore dominance.

The Bottom Line

The AI chip war isn’t some far-off idea anymore; it’s happening right now, in factories, government backrooms, and Wall Street boardrooms. Huawei’s stepping up. Huang is sounding the alarm, and if you’re investing in tech, this is your cue to pay attention.

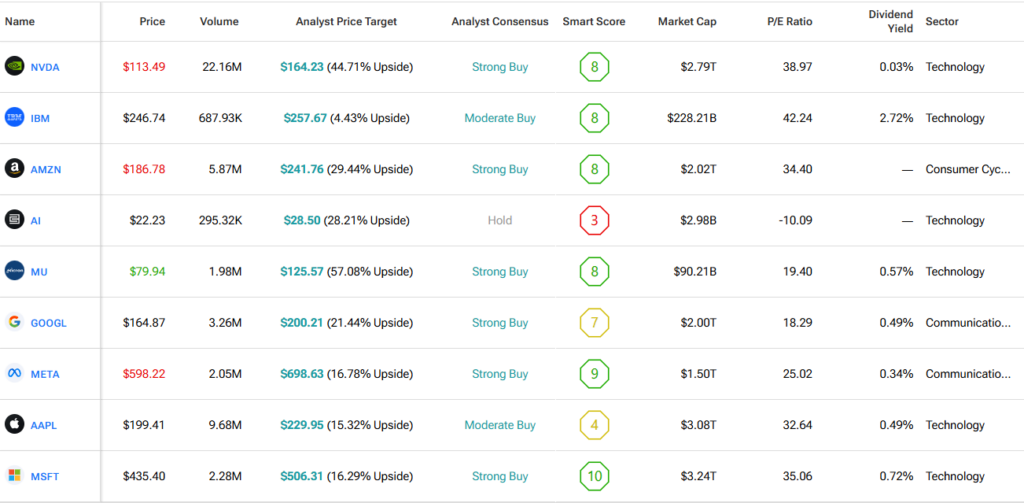

Using Tipranks’ Comparison Tool, we’ve collected and compared the U.S.’s most notable AI companies. This way, one can explore how the stocks compare to each other and gain a wider perspective on the industry and each AI stock.