Canadians who want to see China again will have new options soon, as airline Air Canada (TSE:AC) is looking to ramp up its flights to the country. Investors were fairly happy and sent shares up fractionally in Wednesday morning’s trading. Starting in December, Air Canada will add on more direct flights between Canada and China, thanks in large part to Ottawa’s reversal of a decision that limited such measures going back to 2022.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

By the end of January 2025, direct flights between Vancouver and Beijing will resume as well. Air Canada looks to run service not only to Beijing but also to Shanghai, which demonstrates “…the importance of these markets in Air Canada’s global network…” noted Air Canada’s Vice President of Revenue and Network Planning Mark Galardo.

A New Loyalty Program Too

More destinations is a good way to draw interest, but so too is a worthwhile rewards program. Air Canada is also ramping that up with its Aeroplan, a move that has already proven a top choice for United States travelers looking to get in on a more global rewards point strategy.

While the original Aeroplan goes back to 1984, its history has been long and a bit checkered. But now, Air Canada is revitalizing Aeroplan, bringing back the branded credit cards and establishing a skein of retail partnerships and travel offers, as well to draw more interest to the program.

This should have a positive effect overall; while certainly, discretionary purchases like travel will be under fire for some time, those who were on the fence will now have a much better reason to pull the trigger on the purchase. It will not bring in those who have eschewed discretionary purchases, but anyone who was thinking about it now has one more reason.

Is Air Canada a Good Stock to Buy?

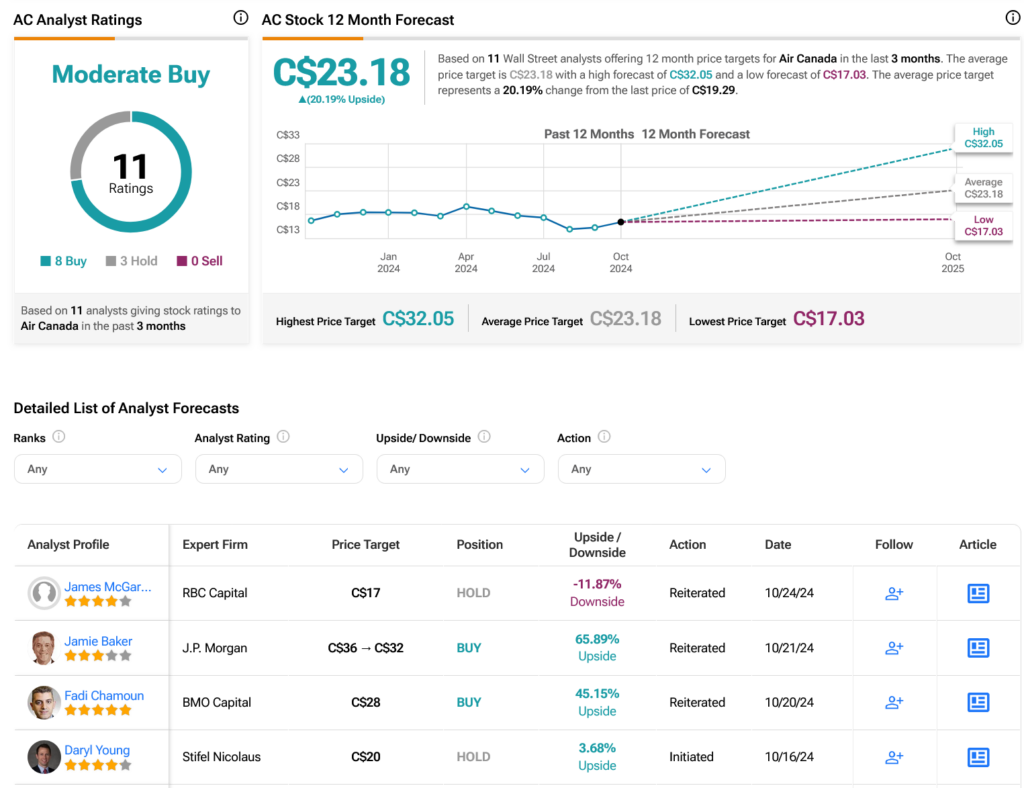

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:AC stock based on eight Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 15.3% rally in its share price over the past year, the average TSE:AC price target of C$23.18 per share implies 20.19% upside potential.