Chinese authorities have asked some local technology companies to temporarily pause plans to buy Nvidia’s (NVDA) H200 artificial intelligence chips, which has created uncertainty around the chipmaker’s return to one of its largest markets. According to The Information, this request came about a month after President Donald Trump said that the U.S. would allow Nvidia to resume selling the chips to China. At the time, Beijing’s response was unclear, especially since it had been encouraging companies to support China’s domestic chip industry instead of relying on foreign suppliers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

People familiar with the matter said that officials want companies to stop placing orders while the government decides whether, and under what conditions, the H200 chips will be allowed into the country. Beijing is trying to prevent firms from rushing to stockpile chips before those decisions are finalized. Indeed, interest from China surged after Trump’s announcement, with several server makers placing enough non-refundable orders to indicate strong demand over the next two years.

At the same time, Chinese officials have been holding meetings with chipmakers and major tech firms to shape the terms of any future purchases. One idea under review would require companies to buy a certain amount of domestic AI chips alongside Nvidia processors, depending on whether local options can handle specific workloads. While domestic chips can handle some AI tasks, they still lag in training large models, thereby making the H200 difficult to replace.

What Is a Good Price for NVDA?

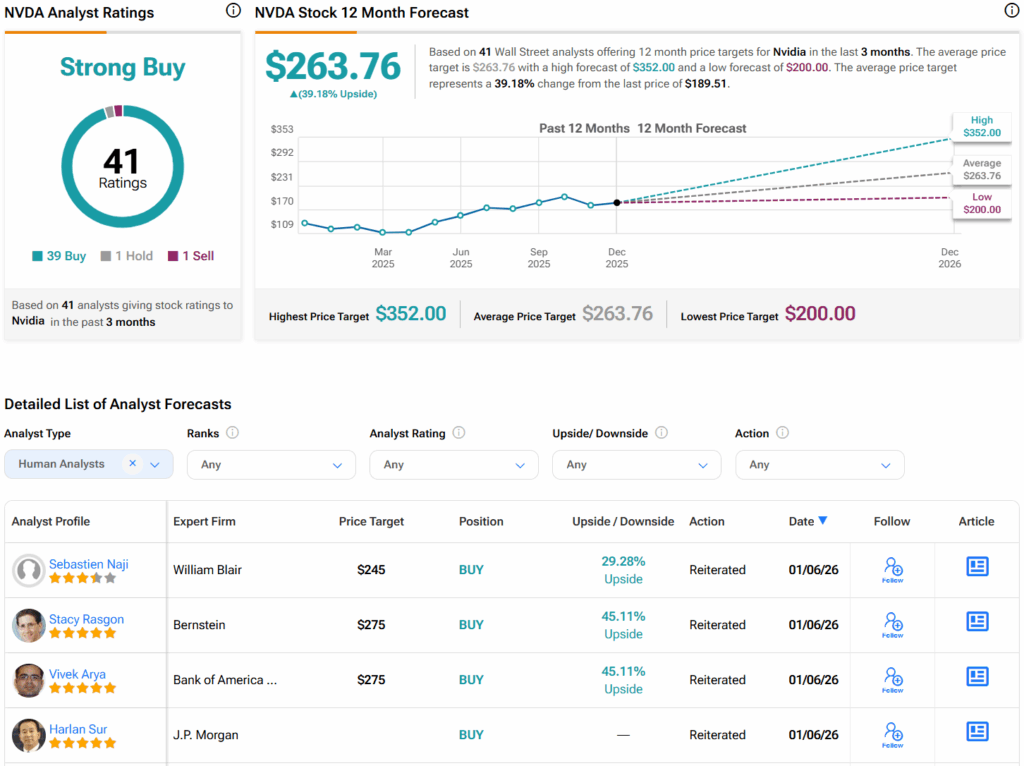

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $263.76 per share implies 39.2% upside potential.