A new joint venture between Chile’s state-owned copper producer Codelco and Sociedad Química y Minera de Chile (SQM) aims to become the world’s largest lithium producer.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The partnership, called NovaAndino Litio, focuses on expanding production at the Salar de Atacama, which is already the world’s largest lithium brine site. Next year, the group plans to submit a request to regulators to increase production by adopting newer extraction methods that require less water.

At present, SQM produces about 230,000 metric tons of lithium carbonate equivalent each year.

Ownership, Policy, and Market Impact

Under the agreement, Codelco will own 50% plus one share of SQM’s Chilean lithium business after 2030. Until then, SQM will continue to run day-to-day operations to maintain stability during the transition period.

This structure reflects President Gabriel Boric’s lithium strategy, which seeks more state control over key resources without full nationalization. As a result, Chile hopes to regain market share lost in recent years to Australia and Argentina.

Meanwhile, the timing matters for investors. Lithium prices remain well below their 2022 highs, following a long supply glut. However, demand from electric vehicles and large battery systems is still expected to rise through the end of the decade.

Technology and Competitive Pressure

A central part of NovaAndino’s plan is direct lithium extraction, a method that pulls lithium from brine faster and with less water use. This is important in the Atacama region, where water access remains a sensitive issue.

If the technology performs as planned, the venture could surpass major global players such as Albemarle Corporation (ALB) and leading Chinese producers. In turn, this would strengthen Chile’s role in the global battery supply chain.

Still, some risk remains. China’s Tianqi Lithium has challenged the deal in Chile’s Supreme Court, arguing it should have required a shareholder vote. At the same time, China’s antitrust regulator has approved the venture with conditions tied to fair supply access.

Taken together, NovaAndino Litio represents a steady and state-backed effort to expand lithium supply at scale, while keeping Chile firmly positioned in a market tied closely to long-term EV growth.

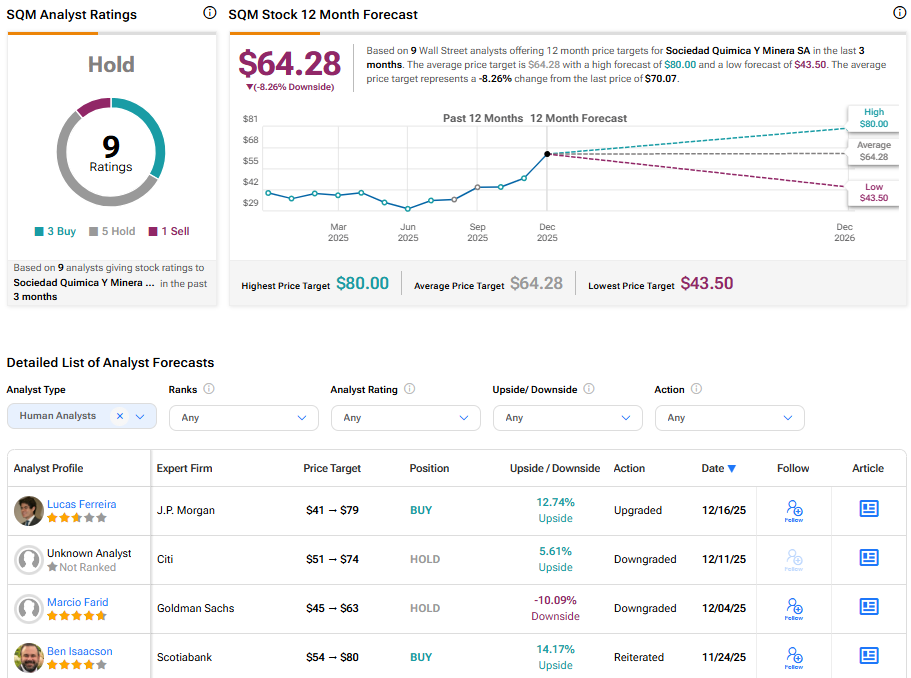

Is SQM Stock a Buy, Sell, or Hold?

Turning to the Street, SQM splits opinions with a Hold consensus rating. The average SQM stock price target is $64.38, implying an 8.26% downside from the current price.