Shares of Chegg (NYSE:CHGG) lost over 32% in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $0.27, which beat analysts’ consensus estimate of $0.26 per share. Sales decreased by 7.2% year-over-year, with revenue hitting $187.6 million. This beat analysts’ expectations of $185.17 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Chegg lost ground in both subscription revenue and total subscribers as well. Subscription Service revenues lost 3% against this time last year, slipping to $168.4 million. Subscription Services subscriber count, meanwhile, stood at 5.1 million, which is down 5% year-over-year.

Chegg’s management also offered projections for the second quarter, which proved disappointing. Chegg looked for total net revenues to come in between $175 million and $178 million, which was a clear miss compared to analyst expectations of $193.65 million. Subscription Services revenue, meanwhile, is projected between $159 million and $162 million, which is a decline on a quarter-over-quarter basis.

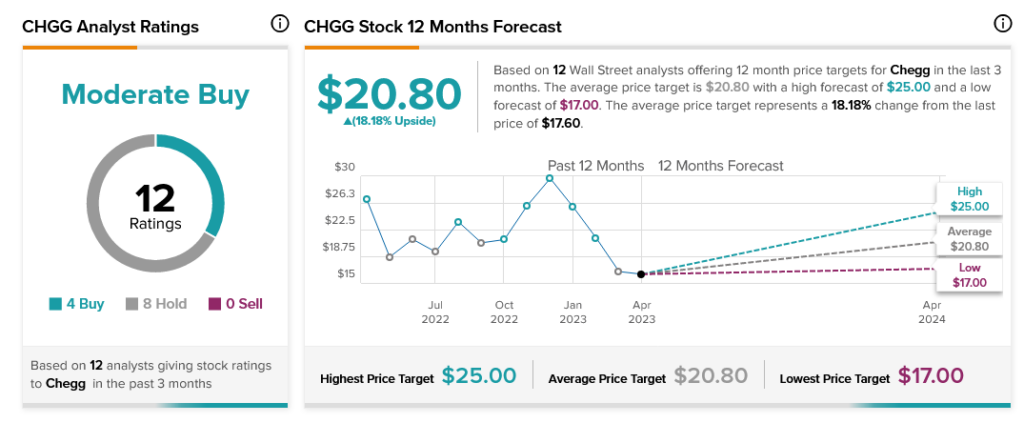

Overall, Wall Street has a consensus price target of $20.80 per share on Chegg stock, implying 18.18% upside potential, as indicated by the graphic above.