Chewy (CHWY) stock has jumped 92% over the past year. The company’s robust performance can be attributed to strong sales growth, driven by its Autoship subscription program, which aims to make pet care more cost-effective. Also, CHWY’s expansion into veterinary services and international markets, along with its focus to boost digital capabilities, supports its performance. Despite massive gains, technical indicators suggest that Chewy is a Strong Buy, implying further upside from current levels.

CHWY is an online retailer of pet food, pet supplies, prescriptions, and other pet-related products.

Analyzing CHWY’s Technical Indicators

According to TipRanks’ easy-to-understand technical analysis tool, CHWY stock is currently on an upward trend. The stock’s 50-day Exponential Moving Average (EMA) is 33.09, while its price is $36.04, implying a bullish signal. Further, its shorter duration EMA (20 days) also signals an uptrend.

Another technical indicator, Williams %R, helps traders determine if a stock is overbought or oversold. In the case of Chewy, Williams %R currently indicates a Buy signal, suggesting that the stock is not overbought and has more room to run.

Further, the Rate of Change (ROC) is a momentum-based technical indicator used to measure the percentage change in stock’s price between the current price and the price from a specific number of periods earlier. Typically, a ROC above zero confirms an uptrend. CHWY stock currently has a ROC of 6.88, which signals a Buy.

Is CHWY a Good Stock to Buy?

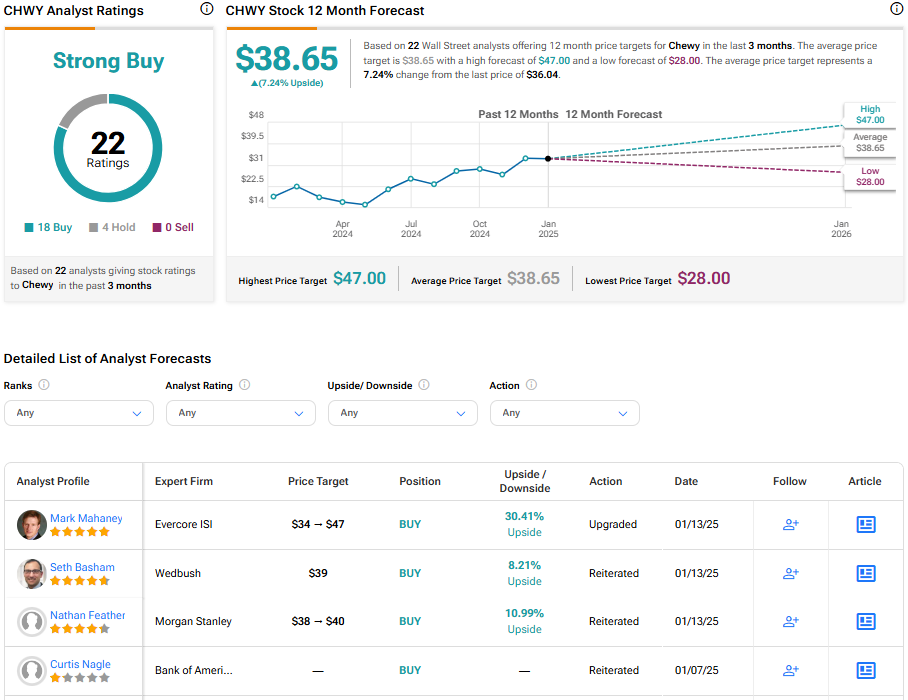

Turning to Wall Street, CHWY has a Strong Buy consensus rating based on 18 Buys and four Holds assigned in the last three months. At $38.65, the average Chewy price target implies 7.24% upside potential.