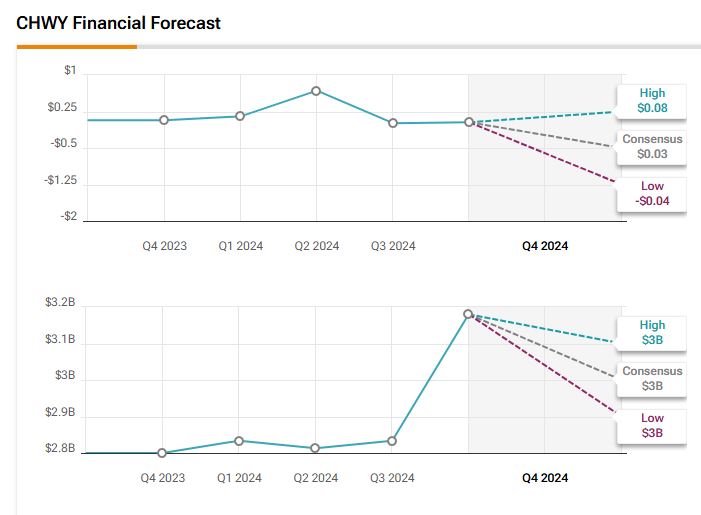

Online pet foods and supplies retailer Chewy (CHWY) is set to announce the earnings results for the fourth quarter of 2024 on March 26. CHWY stock has gained over 120% in the past year, fueled by post-pandemic demand recovery, stronger financials, and improved operational efficiency. Also, Chewy’s emphasis on domestically produced goods positions it well amid trade policy changes. Wall Street analysts expect the company to report earnings of $0.03 per share, representing a 57% increase year-over-year.

Meanwhile, revenues are expected to grow by 12.3% from the year-ago quarter to $3.20 billion, according to data from the TipRanks Forecast page. Notably, Chewy has beaten EPS estimates in seven of the last nine quarters.

Analysts’ Views Ahead of CHWY’s Q4 Earnings

Ahead of Chewy’s Q4 earnings, Seaport Global analyst Aaron Kessler initiated coverage on CHWY stock with a Hold rating and no price target.

Kessler sees Chewy as the top online player in the large U.S. pet market, with strong brand recognition and opportunities to grow its market share, especially in pet healthcare. However, the analyst notes that U.S. pet industry growth has stabilized after the pandemic. It also warns that weaker consumer confidence could impact spending and slow new pet adoptions.

Meanwhile, Raymond James analyst Rick Patel reaffirmed a Hold rating on Chewy stock. For Q4, Patel expects revenue to grow 13% and sees potential upside in EBITDA, given the company’s strong margin control. The analyst notes that Chewy’s revenue growth in FY24 was driven by an increase in active customers and higher spending per customer. For FY25, he forecasts 5% revenue growth, with stable customer growth but a slower rise in spending from newer users.

While he acknowledges improving margins, he believes a “better entry point” is needed for the stock.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 10.44% move in either direction.

Is CHWY Stock a Buy, Sell, or Hold?

Turning to Wall Street, Chewy has a Strong Buy consensus rating based on 15 Buy and three ratings over the last three months. At $41.06, the average CHWY price target implies 20.69% upside potential.

Questions or Comments about the article? Write to editor@tipranks.com