Chevron (NYSE:CVX) shares are ticking higher today after the Energy major posted its results for the fourth quarter and hiked its dividend by nearly 8%. With a year-over-year decline of 16.5%, revenue of $47.18 billion missed expectations by $3.75 billion. However, EPS of $3.45 fared better than estimates by $0.26.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

For the full year, Chevron experienced a decline in earnings due to lower upstream realizations and losses from decommissioning obligations from its asset sales in the U.S. Gulf of Mexico. Still, the company’s worldwide oil and gas production rose by 4% because of its PDC Energy acquisition and gains in the Permian Basin. Further, the firm added 980 million barrels of net oil-equivalent proved reserves in 2023.

At the same time, Chevron’s cash flow from operations trended lower due to lower margins on refined product sales and a decline in commodity prices. Still, the company returned nearly $26.3 billion to investors through dividends and share repurchases in 2023.

Further, Chevron is increasing its quarterly dividend by 8% to $1.63 per share. The CVX dividend is payable on March 11 to investors of record on February 16.

Is CVX Expected to Go Up?

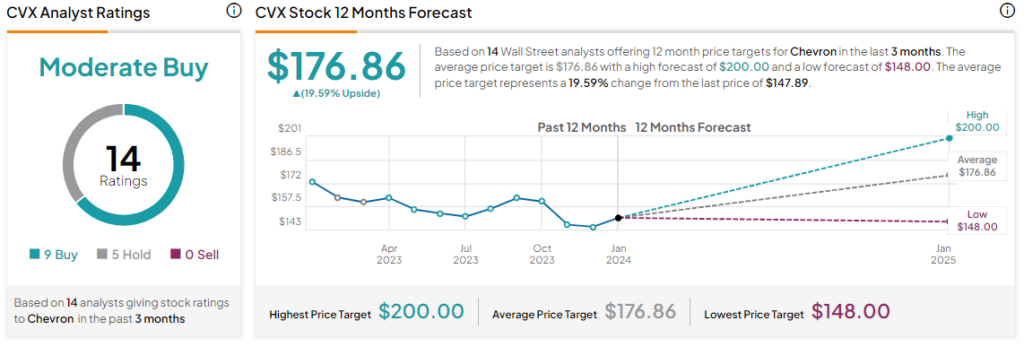

Shares of the company have declined by nearly 14% over the past year. Overall, the Street has a Moderate Buy consensus rating on Chevron, and the average CVX price target of $176.86 points to a substantial 19.6% potential upside in the stock.

Read full Disclosure