Global oiler Chevron (CVX) has suddenly found itself embroiled in ongoing U.S. foreign policy after the firm was tapped directly by Venezuelan authorities to deliver a critical shipment of “naphtha” — a fuel used as a feedstock for gasoline, industrial fuel, and other petroleum products. According to local reports, naphtha supplies have dwindled in recent weeks following an explosion at a refinery owned by the most significant domestic producer, Petrocedeno.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Earlier this week, Venezuela tapped Chevron for deliveries of diluent naphtha after a U.S. destroyer, the U.S.S. Stockdale, intercepted a Russian vessel in Venezuelan waters. The interaction caused uncertainty for shipments associated with Venezuela’s “dark fleet,” prompting Chevron to adjust its logistics strategy.

A Chevron-booked tanker, the Nave Neutrino, was forced to temporarily abandon plans to load crude at the government-operated Jose terminal. Instead, the vessel sailed to the U.S. Virgin Islands to load naphtha destined for Venezuela. Only after discharging that cargo will it be permitted to load Venezuelan crude, underscoring the tight diluent supply following the recent infrastructure damage at Petrocedeno’s processing facility.

Chevron emphasized that its operations remain fully compliant with all U.S. laws and sanctions, maintaining its longstanding position as the only major U.S. oil producer permitted to operate in Venezuela under a sanctions waiver. While Venezuela’s political environment remains fragile, Chevron’s operational presence there continues to demonstrate that top-end firms can secure highly lucrative market positions by operating in high-risk conditions at the nexus of politics and corporate economics, ultimately pursuing deals that other firms would likely avoid.

Recent developments in Venezuela highlight Chevron’s unique market position and ability to manage supply chain disruptions while maintaining compliance with U.S. regulations. Moreover, given the firm’s exclusion from ongoing sanctions and restrictions against Venezuela, it has seemingly ingratiated itself with the current U.S. administration. Probably a financially wise move given recent examples such as Pfizer (PFE) and Palantir (PLTR).

Strong Results Support Geopolitically Sensitive Operations

Setting geopolitics aside, Chevron posted a robust quarter marked by record production and rising capital efficiency. Output climbed past 4 million barrels of oil equivalent per day, supported by consistently high upstream reliability and early integration benefits from the Hess acquisition, which delivered $150 million in quarterly synergies and outperformed initial projections.

Chevron also notched a key milestone in its energy transition strategy, achieving first production at the ACES green hydrogen project in Utah—an initiative that expands the company’s low-carbon portfolio while signaling its long-term commitment to alternative fuels.

Financial performance remained equally strong. Operating cash flow is now running at an annualized pace of roughly $40 billion, underpinned by exceptional execution in the Permian Basin, where production grew by 60,000 barrels per day despite a leaner rig count. This cash strength supported $6 billion in shareholder returns for the quarter, fully funded by adjusted free cash flow.

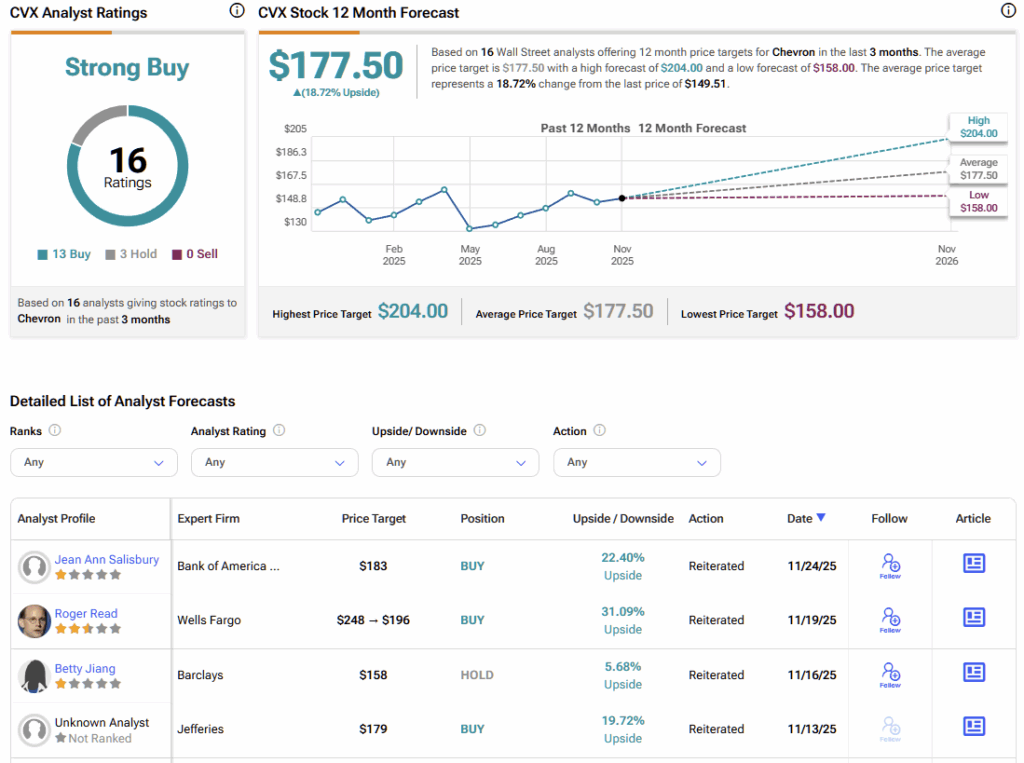

For investors, Chevron’s recent performance underscores its resilience and diversified growth profile, demonstrating its ability to navigate geopolitical complexity while delivering dependable, competitive cash returns.