At its recent Investor Day, Chevron (CVX) shared upbeat news for its shareholders and outlined a long-term growth strategy. The oil giant plans to buy back $10 billion to $20 billion worth of its common stock annually from 2026 to 2030. This reflects the company’s confidence in its future and commitment to rewarding shareholders.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This buyback plan would reflect roughly 3% to 6% of Chevron’s outstanding shares each year. The program is based on the assumption that Brent crude prices average between $60 and $80 per barrel.

Coming to the growth plan, the company expects to grow its free cash flow by more than 10% each year, supported by disciplined capital spending and portfolio optimization.

The company is trimming its yearly capital expenditures to a range of $18 billion to $21 billion, while still targeting 2% to 3% annual growth in oil and gas production through 2030. It also aims to cut costs by $3 billion to $4 billion by 2026, boosting margins and operational efficiency.

Chevron’s Strategic Bets

To achieve these goals, the company seeks support from the Hess acquisition and its entry into AI-powered energy infrastructure.

The recently closed $53 billion acquisition of Hess (HESM) gives CVX access to the highly productive Stabroek block in Guyana, a key asset expected to boost reserves and future cash flow. The company anticipates $1.5 billion in synergies from the acquisition by the end of 2026.

At the same time, Chevron is building a natural gas-fired power plant to meet the massive electricity demands of AI data centers. The first project is underway in West Texas, with initial power expected by 2027.

Is CVX a Buy, Sell, or Hold?

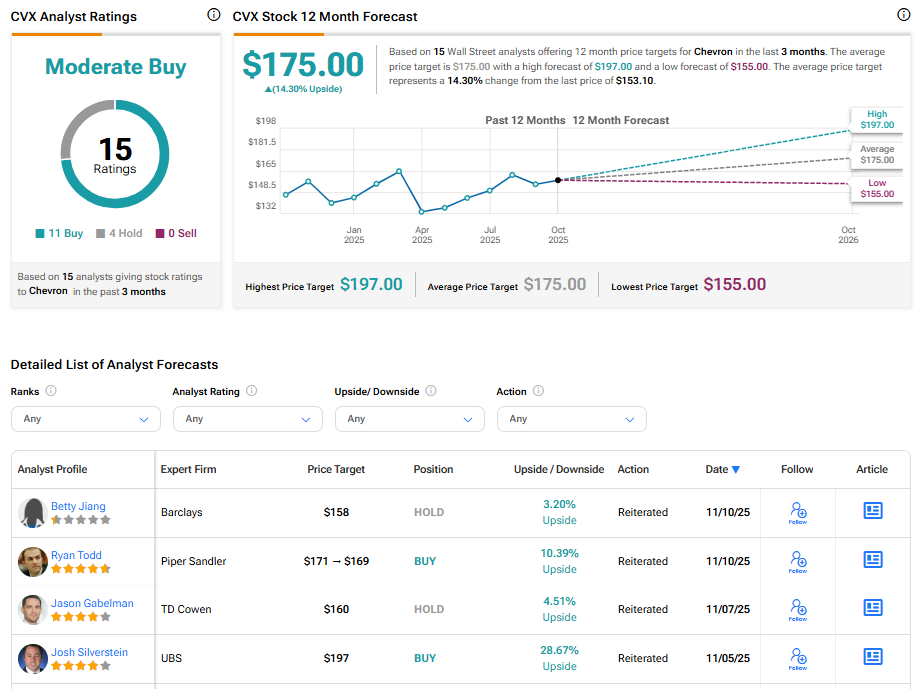

Turning to Wall Street, CVX stock has a Moderate Buy consensus rating based on 11 Buys and four Holds assigned in the last three months. At $175, the average Chevron price target implies a 14.53% upside potential.