Oil major Chevron (CVX) announced that it is laying off nearly 800 employees in Texas as part of its broader restructuring efforts. The news became public on Wednesday through a notice to the Texas Workforce Commission. The layoffs will affect staff at Chevron’s Midcontinent campus on the outskirts of Midland, Texas, and will take effect on July 15. Chevron operates one of its largest global facilities in the Permian Basin, considered the top U.S. oilfield.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Commenting on the layoffs, the company noted, “This is a difficult decision, and we do not make it lightly.” It is offering severance benefits and job seekers’ support to the affected employees.

Chevron Moves Forward with Planned Layoffs

Chevron announced in February that it aims to cut up to 20% (roughly 9,000) of its global workforce by 2026 to streamline costs and operations. In March, the company stated it would lay off at least 600 employees in California, effective June 1. CEO Mike Wirth has targeted $3 billion in structural cost savings to enable the company better withstand the impact of declining oil prices.

Chevron’s Permian Basin is expected to reach an annual production capacity of 1 million barrels of oil equivalent per day in the near term, accounting for almost one-third of its global output. Wirth expects the production to flatten in the latter half of this decade as the company implements its streamlining measures.

Chevron Faces Operational Challenges

Chevron has been under constant pressure lately, with its license to operate in Venezuela revoked earlier and its planned acquisition of Hess (HES) facing an arbitration dispute. On May 28, the U.S. administration granted Chevron a limited license to keep its oil-producing assets in Venezuela but disallowed importing oil from the country into the U.S.

The company faces this situation as the Biden-era waiver to pump oil there expired on Tuesday. In response, Chevron decided to terminate all contracts it had in Venezuela but retained its staff. The challenges in Venezuela stem from the Trump administration’s oil sanctions on the nation.

Is CVX a Good Stock to Buy?

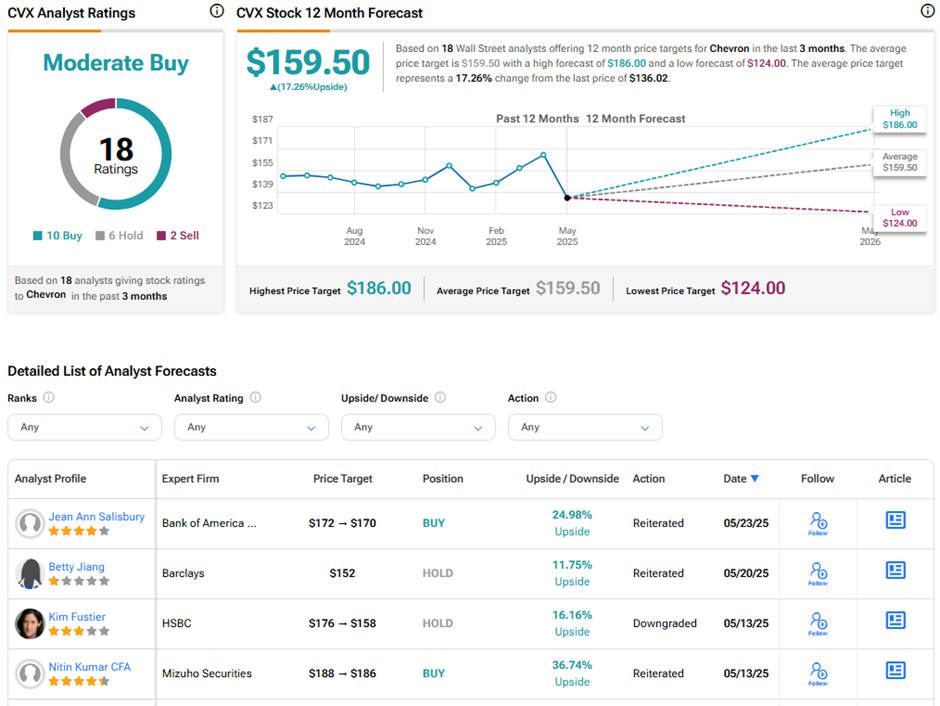

Analysts remain divided on Chevron’s long-term stock trajectory due to the ongoing challenges. On TipRanks, CVX stock has a Moderate Buy consensus rating based on 10 Buys, six Holds, and two Sell ratings. Also, the average Chevron price target of $159.50 implies 17.3% upside potential from current levels. Year-to-date, CVX stock has lost 3.9%.