Chegg shares (NYSE:CHGG) soared over 20% in after-hours trading thanks to its dabbling in AI and quarterly revenue that exceeded expectations. While the company’s Q2 earnings per share settled at $0.28—just a penny shy of estimates—revenue hit $182.9M, outpacing the forecasted $176.51M. As Q3 looms, Chegg anticipates net revenue to land between $151M and $153M. CEO Dan Rosensweig also noted that their beta generative AI launched in May has been well-received, placing them in a unique spot to offer an unmatched learning experience for students.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Chegg’s recent survey revealed that while GenZ students are leaning into AI for education, there’s a touch of unease with the info dished out by ChatGPT. Rosensweig believes Chegg can fill this void with a high-quality, personal learning assistant. He emphasized their plans to craft large language models tailored to education, aiming to craft a vast global community of learners supported by top-notch, cost-effective tools.

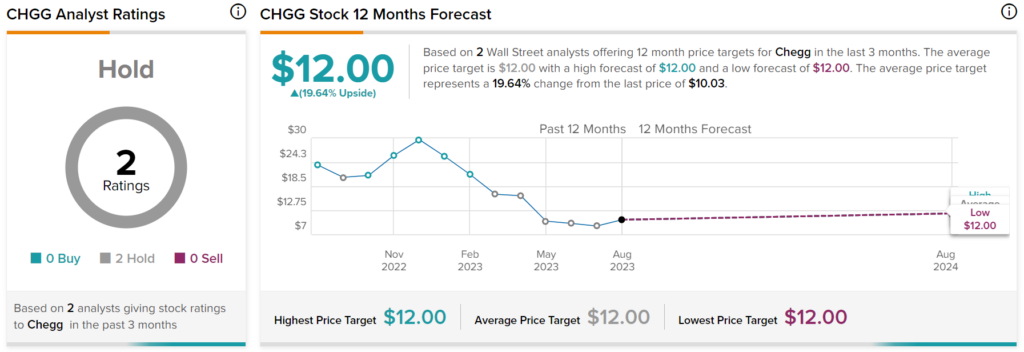

What is CHGG Stock’s Price Target?

Overall, Wall Street has a consensus price target of $12 on CHGG stock, which has currently been surpassed in the after-hours session as shares trade around the mid-$12 range at the time of writing.