Shares of Check Point Software Technologies (NASDAQ: CHKP) were on an upswing in pre-market trading on Monday as the software company beat estimates both on the topline and bottom line. Adjusted Earnings increased 9% year-over-year to $2.45 per share, which beat analysts’ consensus estimate of $2.36 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Total revenues rose 7% year-over-year to $638 million, surpassing estimates by $1.76 million.

During Q4, CHKP bought back shares worth $325 million. The company’s Board of Directors authorized the expansion of its current stock buyback program to $2 billion. Under this extended program, CHKP will be able to continue buying back shares worth $325 million every quarter.

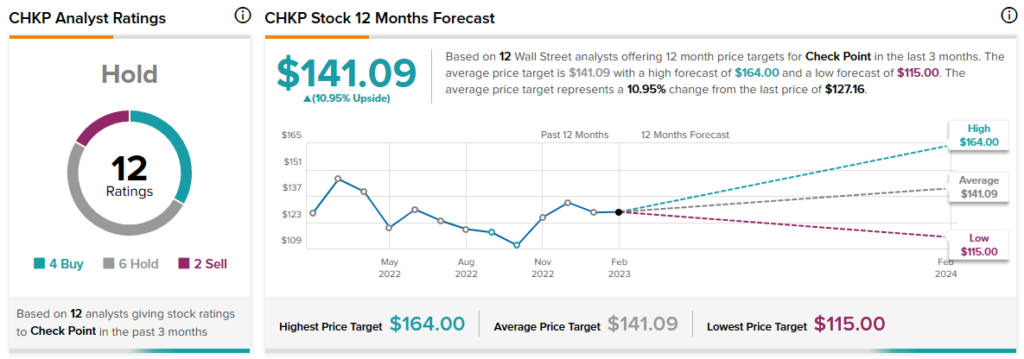

Overall, Wall Street analysts are sidelined about CHKP stock with a Hold consensus rating based on four Buys, six Holds and two Sells.