Shares of AI-powered solutions provider Cerence (NASDAQ:CRNC) are trending higher in the early session today after the company delivered healthy top-line growth for the fourth quarter. Revenue increased by nearly 39% year-over-year to $80.76 million, comfortably exceeding estimates by $6.4 million. On the other hand, EPS of $0.09 missed the cut by $0.06.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Cerence’s solutions are primarily focused on the automotive industry. The company bagged over a dozen strategic deal wins in the auto business during the year. Additionally, it is making progress in the two-wheeler and trucking segments with its conversational AI technology.

During the quarter, adjusted total billings rose by 6% over the prior year, and the percentage of global auto production with Cerence technology remained at an impressive 54%.

Looking ahead to the Fiscal quarter ending December 31, 2023, Cerence expects revenue to be in the range of $128 million to $132 million. Adjusted EBITDA for the quarter is anticipated to be between $58 million and $62 million.

For the Fiscal year ending September 30, 2024, the company anticipates revenue to be between $355 million and $375 million. Adjusted EBITDA for the year is seen hovering between $94 million and $109 million.

What Is the Target Price for CRNC?

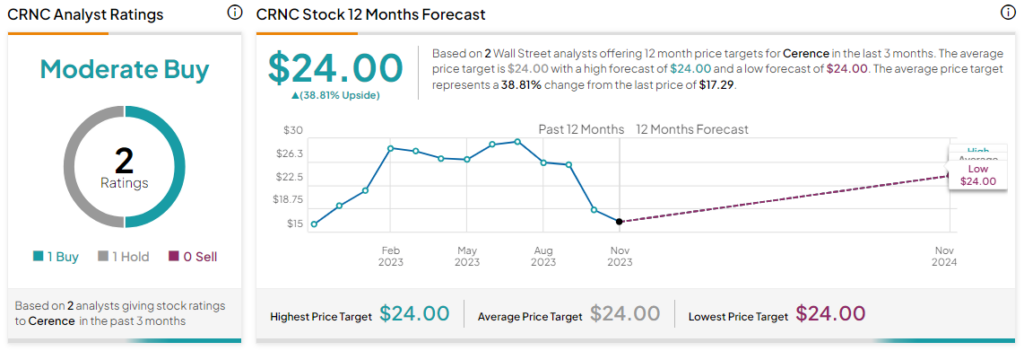

Overall, the Street has a Moderate Buy consensus rating on Cerence. After a nearly 32% drop in the company’s share price over the past six months, the average CRNC price target of $24 points to a mouth-watering 38.8% potential upside in the stock.

Read full Disclosure