Shares of Cenovus Energy (TSE: CVE) plunged nearly 7% on Tuesday morning after the Calgary-based oil and gas company reported a wider loss in the fourth quarter of 2021.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Revenues & Earnings

Total revenues came in at C$13.7 billion in Q4 2021, compared to C$3.5 billion in Q4 2020, thanks to higher average selling prices for the company’s products in the upstream and downstream segments.

Adjusted funds flow was $1.9 billion ($0.97 per share), up from $333 million ($0.27 per share) a year earlier.

Upstream production in the fourth quarter increased to 825,300 barrels of oil equivalent per day from 467,200 boepd in the fourth quarter of 2020.

Total downstream throughput for the quarter was 469,900 barrels per day, down from 169,000 a year earlier.

Cenovus reported a loss of C$408 million (-C$0.21 per share) for the quarter ended December 31, compared with a loss of C$153 million (C$-0.12 per share) in Q4 2020. The company took a C$1.9-billion non-cash one-time impairment charge related to its U.S. refining business.

CEO Commentary

Cenovus president and CEO Alex Pourbaix said, “In our first year as a combined company we delivered exceptional operational performance at our upstream business, successfully integrated the assets acquired in the Husky transaction and aggressively reduced debt, creating a stronger company,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “We exceeded our expected transaction synergies and enhanced shareholder returns, doubling our quarterly dividend and commencing our share buyback program. In addition, we’re well positioned to consider future opportunities to further enhance returns for our shareholders.”

Wall Street’s Take

On February 4, National Bank analyst Travis Wood kept a Buy rating on CVE and raised its price target to C$28 (from C$25). This implies 51.8% upside potential.

The rest of the Street is bullish on CVE with a Strong Buy consensus rating based on 13 Buys. The average Cenovus Energy price target of C$23 implies 24.8% upside potential to current levels.

TipRanks’ Smart Score

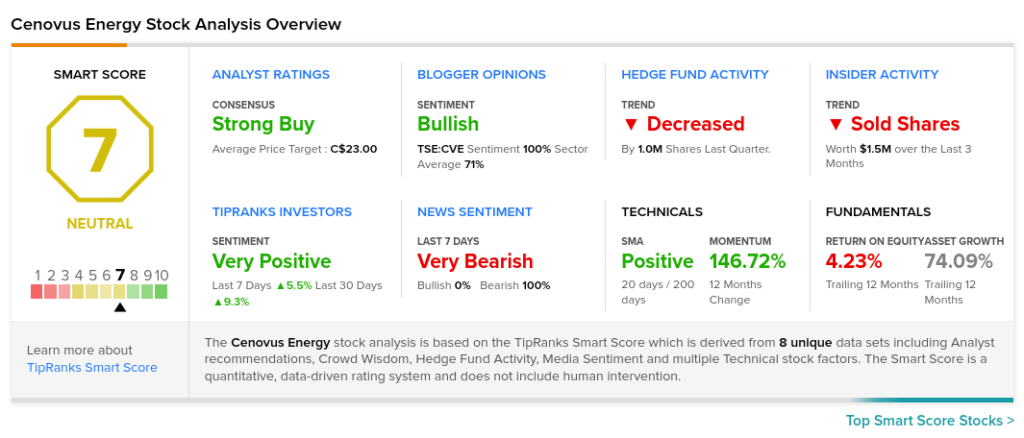

CVE scores a 7 out of 10 on TipRanks’ Smart Score rating system, indicating that its stock is likely to perform in line with the overall market.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

Suncor Energy Swings to Profit in Q4

Imperial Oil Swings to Profit in Q4, Raises Dividend

Parkland Buys M&M Food Market