Cement giant Cemex (CX) reported a nearly threefold increase in first-quarter net profit to $734 million, primarily driven by strategic asset sales, including a significant divestment in the Dominican Republic. Despite this profit surge, the company faced headwinds as revenue declined 7% year-over-year to $3.65 billion. Following the announcement, Cemex shares jumped, pushing the stock up over 7% in the past few days.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Mixed Financial Performance

For the quarter, net profit soared to record levels, while operating EBITDA dropped 18% to $601 million compared to the same period last year. Company officials attributed much of this decline to currency effects, particularly the depreciation of the Mexican peso against the dollar.

“Our strategic divestments have significantly strengthened our financial position, even as we navigate currency headwinds in key markets,” noted a company spokesperson in the earnings release.

The company’s pricing strategy helped cushion some revenue pressure, with cement and ready-mix prices increasing by 2%, while aggregate prices rose by a more substantial 4%. Additionally, energy costs fell by 17% per ton of cement produced, providing important cost savings that supported overall profitability despite the revenue decline.

Cemex currently maintains a leverage ratio of 1.9x, slightly higher than the prior quarter, but still within targeted ranges for the company’s long-term debt management strategy.

Analyst Response

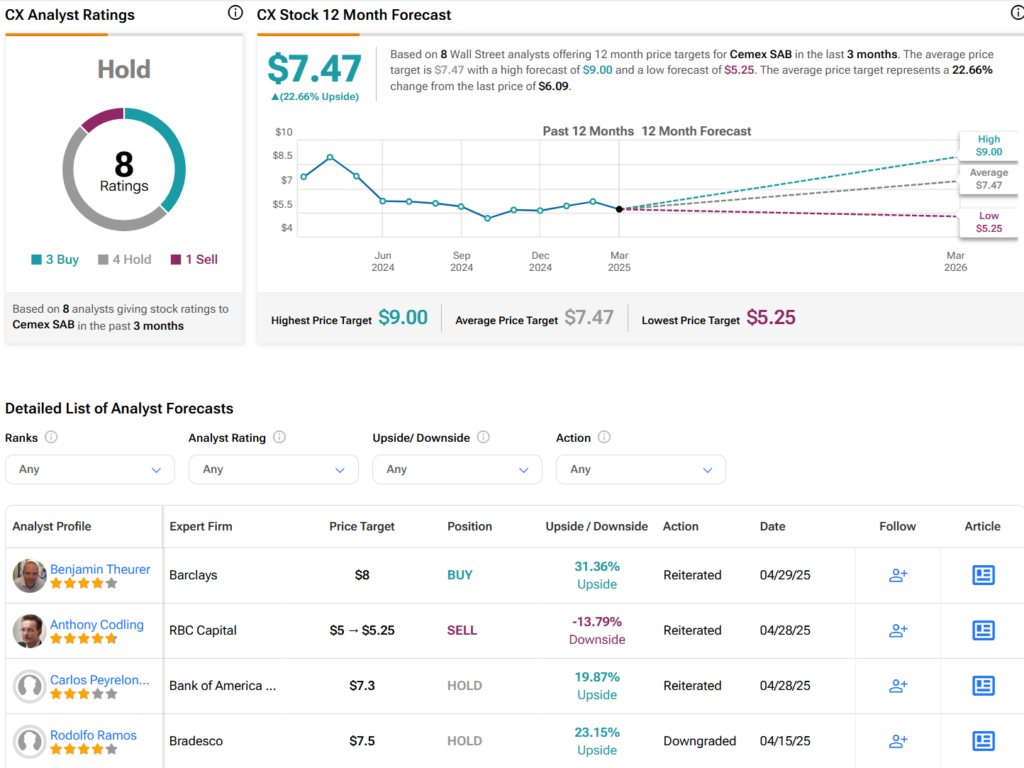

Analysts following the company have taken a cautious view of the stock’s prospects. For instance, after the earnings release, Bank of America’s Carlos Peyrelongue maintained a Hold rating with a $7.30 price target. He noted that while new CEO Jaime Muguiro’s strategic priorities of deleveraging, targeted acquisitions, and enhanced profitability could positively impact future performance, current valuation reflects a balance of risks and opportunities.

“The stock trades at an attractive valuation, but investors should consider potential risks including higher interest rates, geopolitical uncertainties, and fiscal challenges in Mexico,” Peyrelongue commented.

Cemex is rated a Hold overall, based on the most recent recommendations of eight analysts. The average price target for CX stock is $7.47, representing a potential upside of 22.66% from current levels.

Looking Ahead

Despite the mixed results, Cemex management expressed confidence in meeting its annual EBITDA target of at least $3 billion for 2025. The company plans to continue focusing on deleveraging initiatives while pursuing strategic acquisitions to enhance profitability.

While cement volumes declined in key markets like Mexico and the United States, the company saw growth in other regions such as Europe, the Middle East, Africa, and South/Central America, pointing to geographic diversification as an important factor in the company’s resilience.

Investors will be watching closely to see if Cemex can maintain its profit momentum while addressing the revenue and EBITDA challenges in the coming quarters, particularly as the new CEO implements his strategic vision for the global cement leader.